Transportation Sector in Iraq: Aviation and Maritime

Report Summary

KAPITA’s Research Department

Aviation

Air transport plays a vital role in economic growth and development, serving as a gateway to the international economy and providing crucial connectivity on a regional, national, and international level. It aids in generating trade, promoting tourism, and creating employment opportunities. Aviation provides the only high-speed global transportation system, making it key to international business.

Iraq took its initial steps towards aviation in 1933 with the establishment of Al-Muthana Civil Airport, and on January 29, 1946, Iraqi civil aviation made its first flight. Civil aviation in Iraq had enormous promise at its inception, but owing to the numerous obstacles and challenges it has experienced over the years, its role in the growth of economic and social elements has been minimized, despite the country's riches. Until recently, the public sector was the primary body in charge of civil aviation; currently, an increasing number of privately-owned companies are entering the scene.

There are three government bodies responsible for civil aviation in Iraq. The Iraqi Civil Aviation Authority (ICAA), the General Company for Air Navigation and Services (GCANS), and Iraqi Airways. ICAA is the high authority in charge of controlling Iraqi airspace and issuing licenses for aviation staff, as well as authorization to land on and depart from Iraqi airports.

GCANS harbors more than 270 air traffic control officers providing air combat command, approach command, and air traffic control tower services. Iraqi Airways is the country's national airline, based on the grounds of Baghdad International Airport in Baghdad, and it is the Middle East's second oldest airline, founded in 1945. Iraqi Airways provides both domestic and regional services.

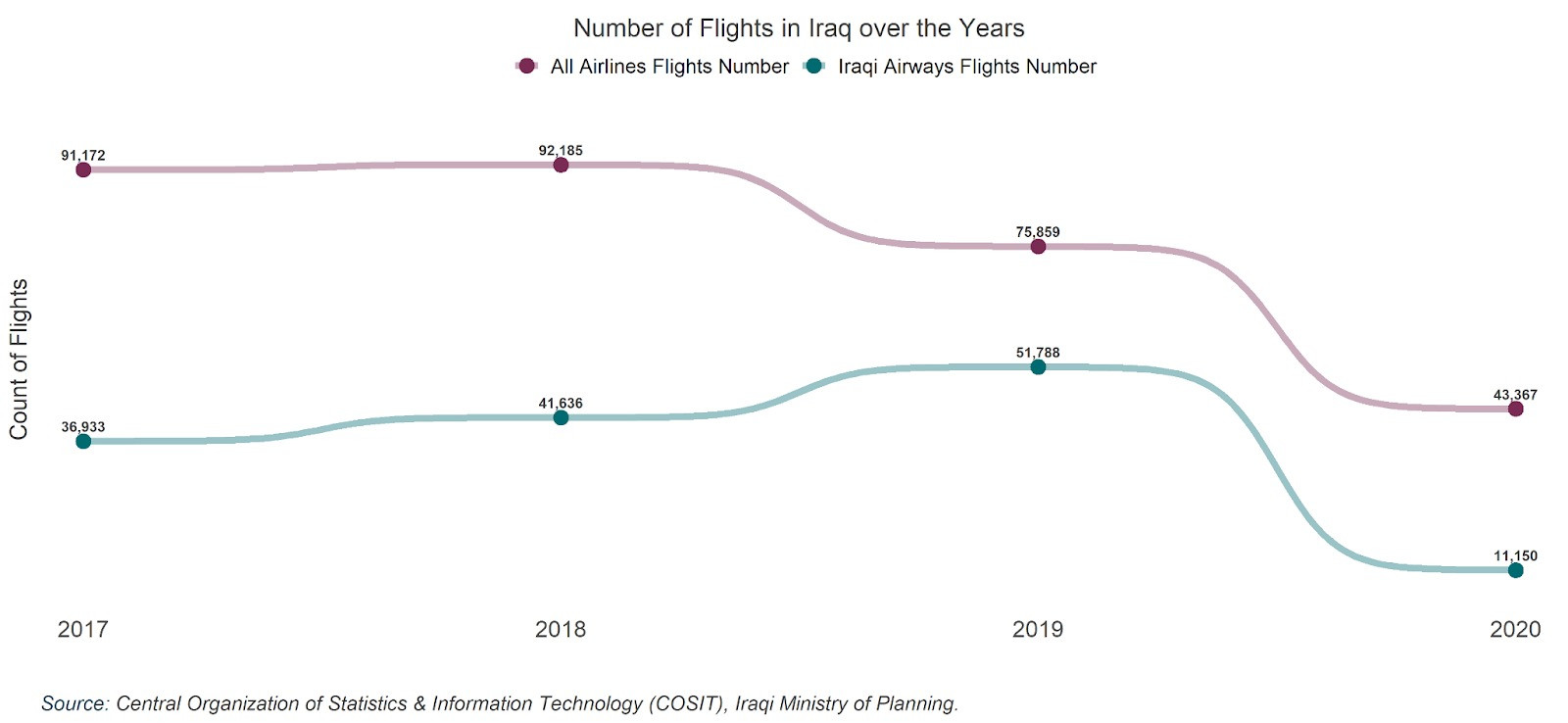

According to the Central Organization of Statistics and Information Technology, the number of flights over the years prior to 2019 witnessed a steady flow, with flights operating under Iraqi Airways constituting 40.5% and 44.8% of the overall number of flights in 2017 and 2018, respectively. In 2019, however, the majority of flights were operated by Iraqi Airways, which took up 68.2% of the total number. In addition, authorities imposed travel restrictions on more than 13 nations in 2020, not to mention other countries that banned flights from Iraq due to the COVID-19 pandemic. This can be seen through the dramatic drop in the number of flights within the same year.

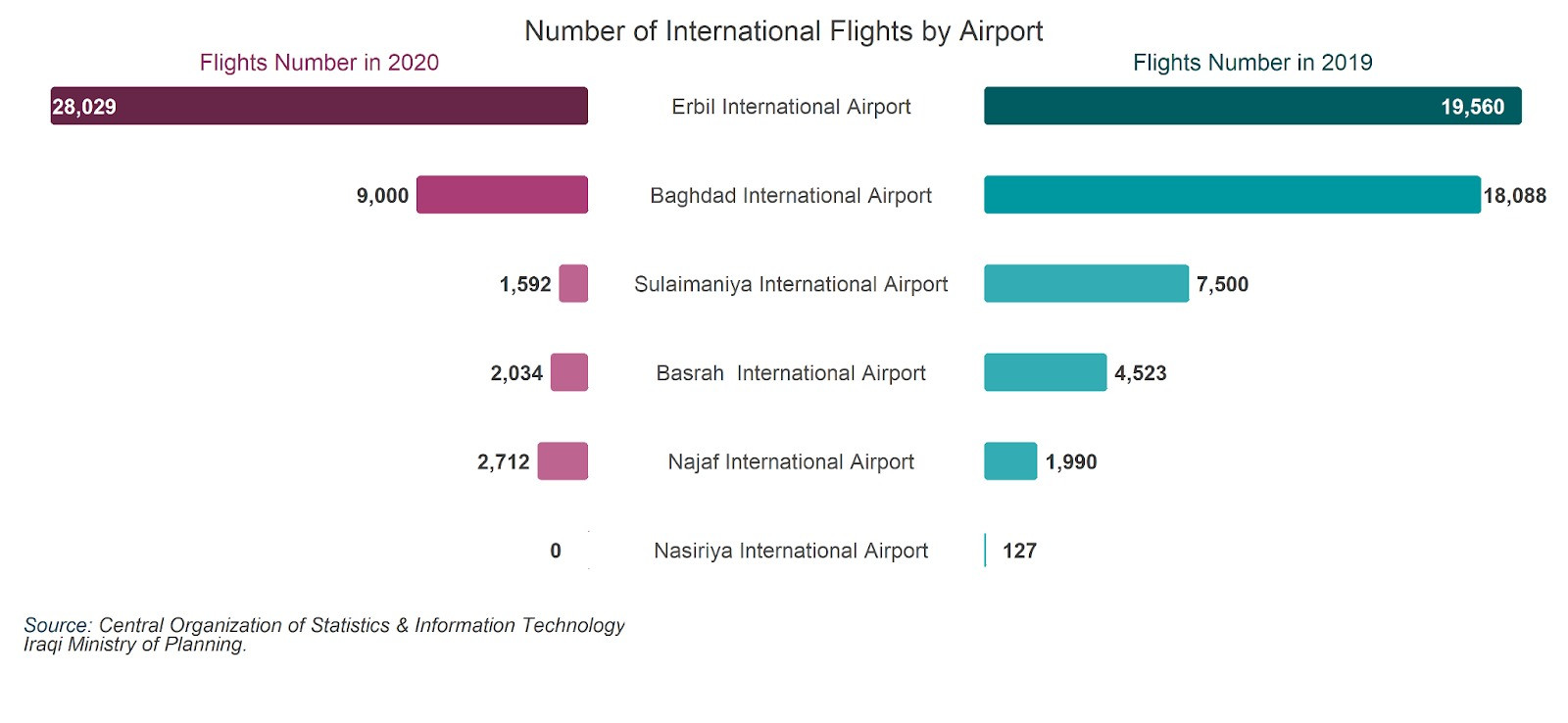

In terms of airports, Erbil International Airport is the main airport operating within the capital of the Kurdistan Region in Iraq, Erbil, and it takes the lead when it comes to the number of international flights within the years 2019 and 2020, with a total of 47,589 flights.

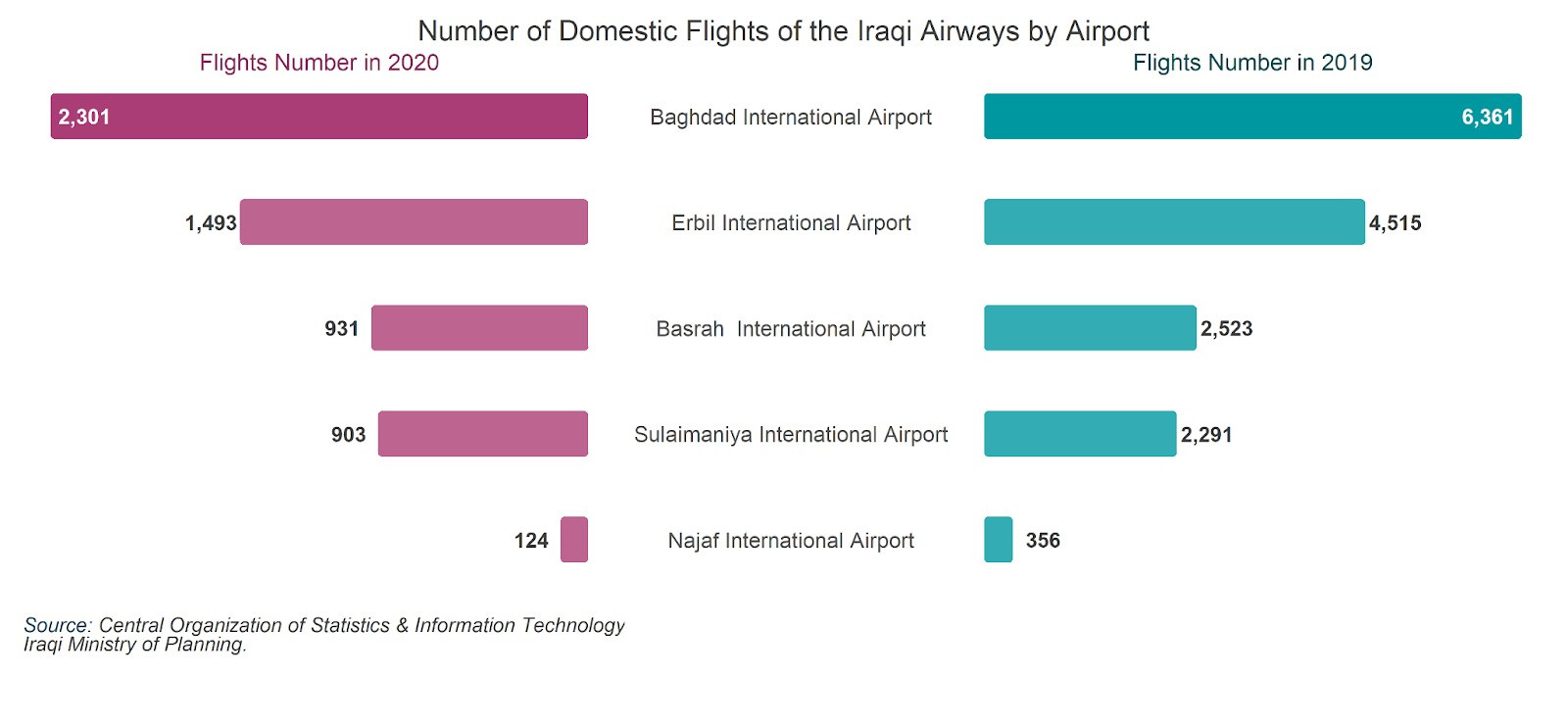

Baghdad International Airport is Iraq's largest airport and serves the most airlines; nonetheless, it ranks second with 27,088 international flights in those two years. When it comes to domestic flights, Baghdad serves as a link for Iraq's northern and southern provinces. This explains why Baghdad International Airport has the highest number of domestic flights out of all Iraqi airports.

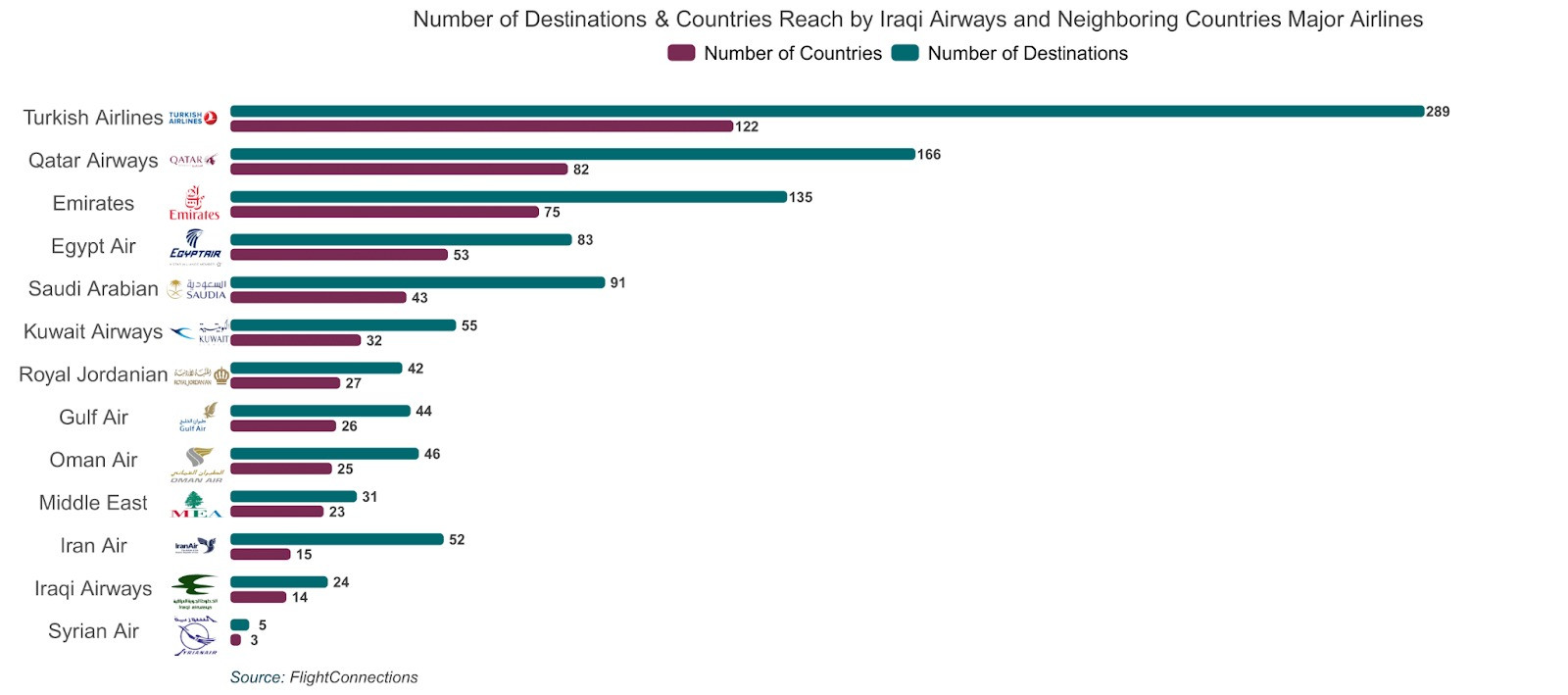

Although numerous new airlines, such as Fly Baghdad, Fly Erbil, and UR Airlines, are making a name for themselves, Iraqi Airways remains the largest airline company in the country. However, compared to major airlines in neighboring countries, Iraqi Airlines ranks at the bottom of the list with 24 destinations in 14 countries. Turkish Airlines has the broadest destination reach within the Middle East, with 289 destinations in 122 countries. Qatar Airways is second, followed by Emirates.

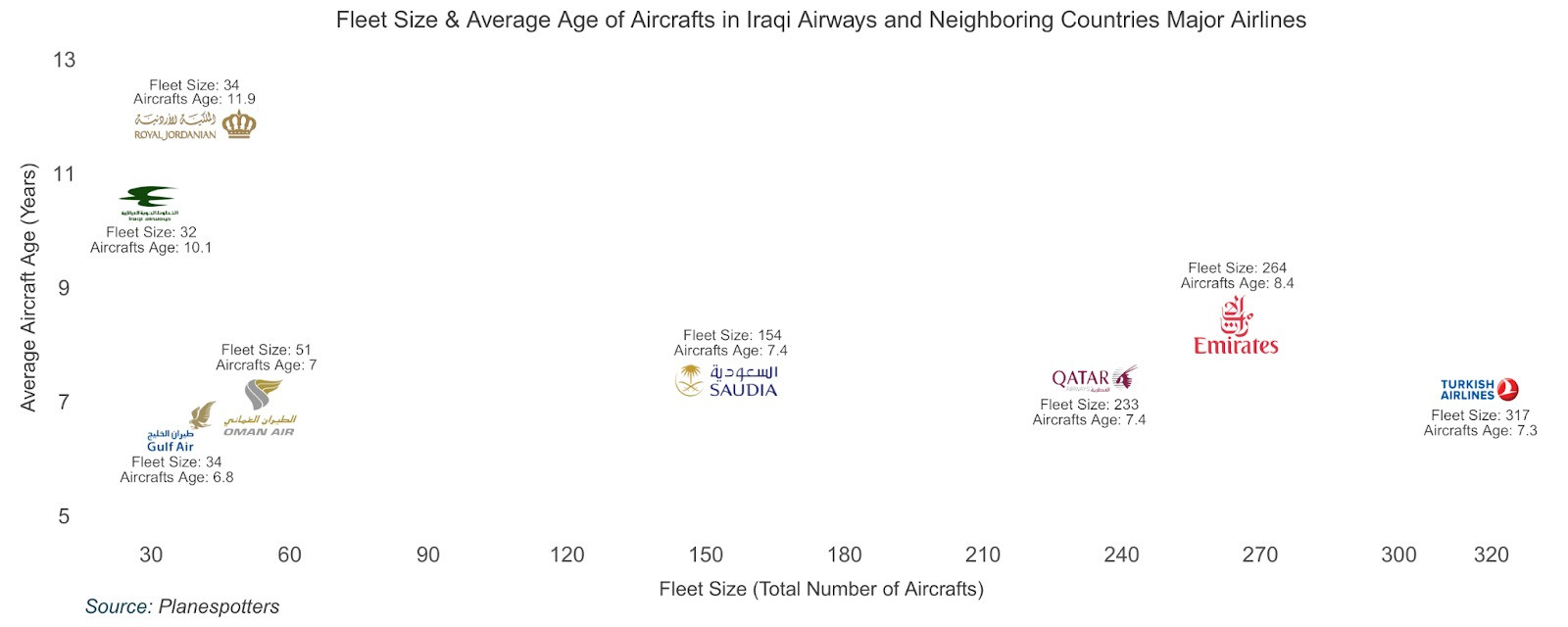

One of the main reasons for this is the Iraqi Airways’ limited and out-of-date fleet of 32 aircrafts and an average age of 10.1 years per plane, only 19 of which are operational. For comparison, Emirates Airlines has a total of 265 airplanes, 197 of which are active, and the rest are parked, with an average age of 8.4 years. Saudia Airlines has 154 aircrafts, 138 of which are operational, with an average aircraft age of 7.4 years.

Recent efforts to strengthen the position of Iraqi Airways have included the purchase of Boeing 737 MAX and Boeing 787 Dreamliner aircrafts, which are yet to be delivered, and the arrival of an Airbus A220-300 aircraft in January of this year, the first of 5 which were purchased in 2013.

Another major issue to touch on is the lack of efficient aviation academies in the country. Young Iraqis who aspire to enter the aviation sector, whether as pilots or aircraft maintenance engineers, or in other aviation professions, nearly always study abroad. With only one ICAA-accredited academy in Iraq, which has many fundamental deficiencies, Iraq is left with a need for aviation training institutes that can fill the void.

Recent Projects

There are several projects to construct more airports in the critical parts of the country, of which:

The Euphrates Central Airport Project: Is centrally located between Babylon, Karbala, Najaf, and Al-Diwaniya. During the first, second, and third stages, the endeavor is designed to carry 6, 12, and 20 million people per year, respectively.

Mosul International Airport Rehabilitation Project: According to the Iraqi national investment committee, a project is now ongoing to rehabilitate the airport, which will comprise runways and associated infrastructure, buildings, and a watchtower. The project would entail the development of 15,000 square kilometers of land.

Duhok International Airport Project: The building of the Duhok International Airport began in September 2012 with a $450 million investment budget. The project was forced to suspend due to the Islamic State's conflict and the ensuing financial crisis. According to official sources, only 10% of the project has been finished thus far.

Maysan Airport Project: The project will be held on the grounds of Al-Bitterah Military Airport, which is owned by the Ministry of Finance. The venture is new, and the cost of which has not been specified.

ICT Businesses in Air Transport

Since internet booking has been unavailable to Iraqis for the longest time, they have relied on travel agencies and airline offices to book their tickets. However, as online payment options such as ZainCash, AsiaHawala, and credit/debit cards have grown in popularity, so has online booking. Furthermore, many ICT apps have emerged to act as a medium between clients and online booking, giving them the convenience of internet booking and removing the burden of going to a travel agent. Currently, Iraqi airline companies such as Fly Baghdad, Fly Erbil, and Iraqi Airways have implemented online booking through their websites. However, the online portal is still under maintenance for the latter.

Sindibad: It is an online travel agency. It allows customers to book and pay for flights directly through their website or application, utilizing online payment options like credit/debit cards or ZainCash, or in cash via an agent who collects the payment from the customer at their specified location free of charge.

Kawenter: Headquartered in Baghdad, Kawenter is a startup application that was founded in 2021, seeking to facilitate and simplify travel and visa procedures. The application allows its users to apply for e-visas, use its tools to streamline and simplify visa processes and learn about entrance criteria for over 180 countries worldwide.

SAFR: is a startup specializing in providing comprehensive travel services such as airline tickets, hotel bookings, and custom-designed packages for both private and public travel. Safr was founded in 2020 and is authorized by Iraq's Ministry of Culture and Tourism. It already has over 100 global partners situated in various tourist locations, including Lebanon, the United Arab Emirates, Turkey, Spain, Italy, the United Kingdom, Germany, France, the Netherlands, Switzerland, Sweden, China, and the Maldives. Furthermore, it facilitates issuing visas to the UAE, Jordan, Oman, Egypt, Turkey, Thailand, and India and entrance permits to Iraq for foreigners.

SAFR: is a startup specializing in providing comprehensive travel services such as airline tickets, hotel bookings, and custom-designed packages for both private and public travel. Safr was founded in 2020 and is authorized by Iraq's Ministry of Culture and Tourism. It already has over 100 global partners situated in various tourist locations, including Lebanon, the United Arab Emirates, Turkey, Spain, Italy, the United Kingdom, Germany, France, the Netherlands, Switzerland, Sweden, China, and the Maldives. Furthermore, it facilitates issuing visas to the UAE, Jordan, Oman, Egypt, Turkey, Thailand, and India and entrance permits to Iraq for foreigners.

Babylon Booking: A B2B flight booking service that merges over 700 airlines, including over 150 low-cost carriers, from many global distribution systems, suppliers, and third-party APIs. Moonline Travel and Trade owns the enterprise, which has operations in Iraq, Turkey, the United Arab Emirates, and Germany. It offers a user-friendly interface and seamless invoicing, the portal allows IATA and non-IATA travel firms to purchase and issue airplane tickets in only a few clicks. Additionally, it provides travel companies with pre-built solutions, tools, templates, detailed reports, data, and ongoing assistance.

Babylon Booking: A B2B flight booking service that merges over 700 airlines, including over 150 low-cost carriers, from many global distribution systems, suppliers, and third-party APIs. Moonline Travel and Trade owns the enterprise, which has operations in Iraq, Turkey, the United Arab Emirates, and Germany. It offers a user-friendly interface and seamless invoicing, the portal allows IATA and non-IATA travel firms to purchase and issue airplane tickets in only a few clicks. Additionally, it provides travel companies with pre-built solutions, tools, templates, detailed reports, data, and ongoing assistance.

Recommendations and Conclusion:

Iraq has suffered from extended periods of instability and turmoil, from the numerous wars during the time of the previous regime to the Iraq war, the ISIS occupation, and the COVID-19 pandemic, not to mention the corruption within its governmental systems. All of which have heavily hindered the development and advancement of the aviation sector, and have set the aviation sector of the country far behind those of its neighboring countries.

However, this has left Iraq with a lot of room for development. As the country continues its efforts to expand the transportation sector, investors are presented with numerous opportunities to utilize, where tackling any of the previously mentioned challenges is a potential investment venture. The undergoing projects of Duhok and Mosul international airports, for example, will require baggage handling, food catering, and security services once operational.

Furthermore, with the growing demand for pilots in Iraq, the government and investors should be encouraged to participate in localizing aviation training. This would have a significant positive impact on the sector as a whole.

Maritime

The maritime sector is an essential pillar of Iraq’s economic infrastructure; it links the country’s national systems to the global market, facilitates the flow of goods and commodities, and ensures the flourishing of port cities and the country as a whole. Iraq’s maritime transport is limited to a coastline of approximately 48 km sitting between the borders of Iran to the east and Kuwait to the south, where Shatt Al-Arab canal is the only linkage that connects Iraq to the Persian Gulf. All the ports of the country are located in the province of Basra under the management of the General Company for Ports of Iraq (GCPI). The ports consist of Al-Basra and Khor Al-Amaya oil terminals, and four commercial ports; Al-Maqil, Khor Al-Zubayr, Abu Flous, and Umm Qasr, of which Umm Qasr is the main and only deep-water port in the country. The maritime shipping activities, however, are handled by the State Company for Maritime Transport (SCMT), which is located in Baghdad and has a branch in Basra. SCMT initiated its operations in 1952, as of 2020 it has 1264 employees, and owns a fleet of 7 ships.

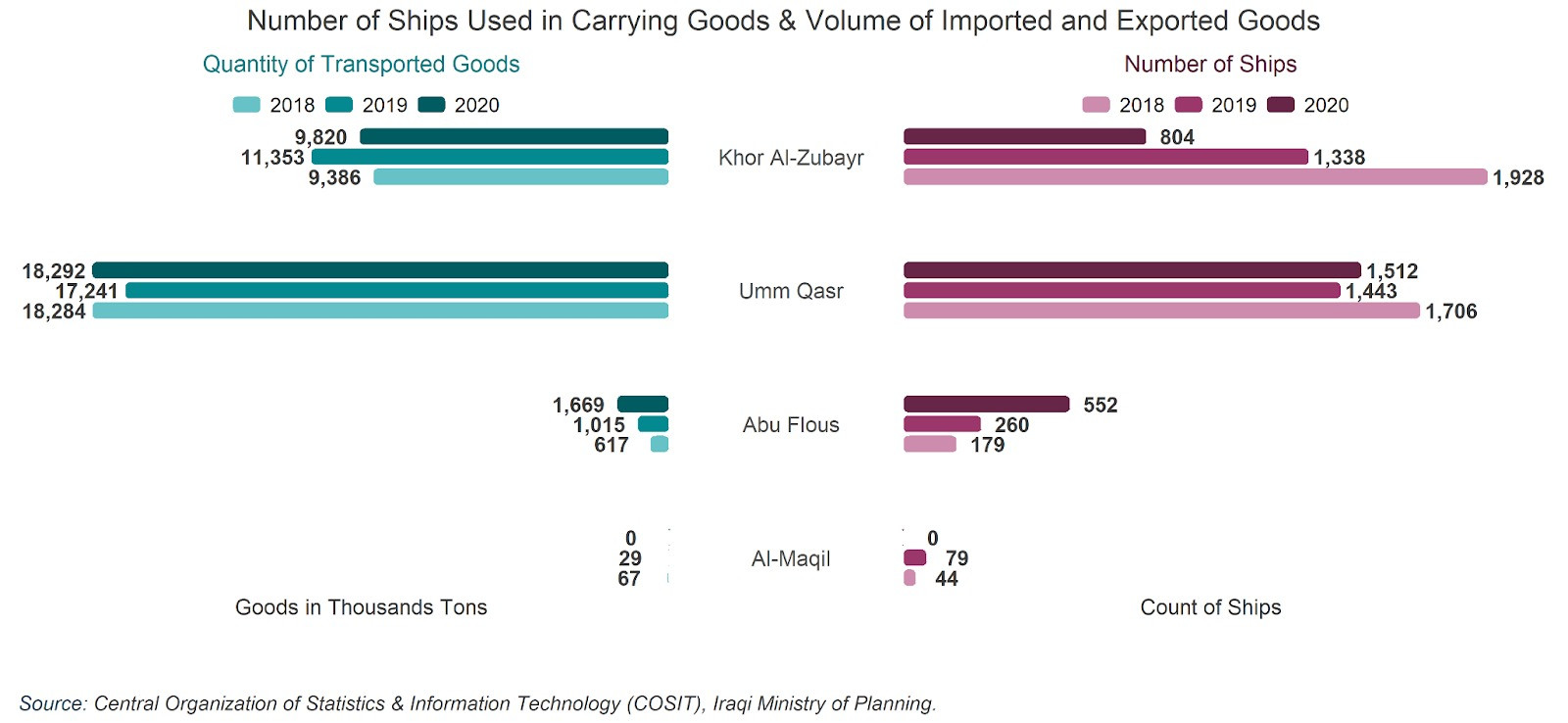

Umm Qasr is Iraq’s biggest and sole deep-water port. Thus, it is only natural that it would carry the majority of maritime transport activities in the country. With an average of 18 million tons of transported goods in recent years, Umm Qasr port has kept a persistent record in maintaining Iraqi maritime transport.

The second-largest port is Khor Al-Zubayr, which transported 9.8 million tons of goods in 2020, a 13.5% decrease from the previous year. Nevertheless, it is worth noting that despite the complications brought forth by the pandemic, the anti-corruption measures implemented by the Iraqi government were able to bridge the gap and keep maritime transport floating.

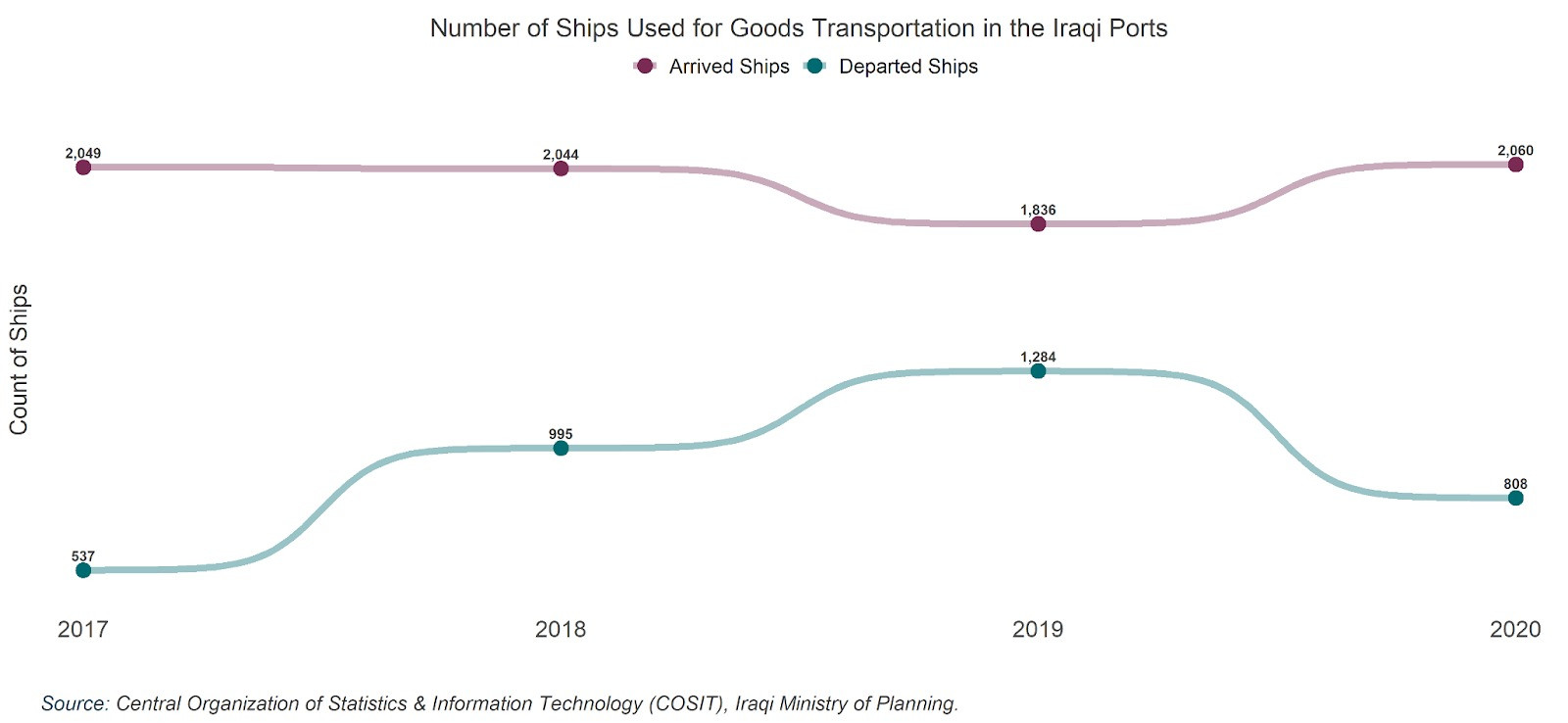

There is a direct relationship between the amount of cargo imported or exported and the number of operating maritime vessels. Generally, an increase in imports and exports translates to an increase in the number of ships transporting the goods. Hence, the 12.2% increase in arriving ships in 2020 from its previous year is attributed to the rise of the imports of the country. The number of departing ships in the corresponding year exhibited a 37% decline compared to 2019 due to the decrease in exports in light of the collapse of international markets and the restrictions imposed by the COVID-19 pandemic.

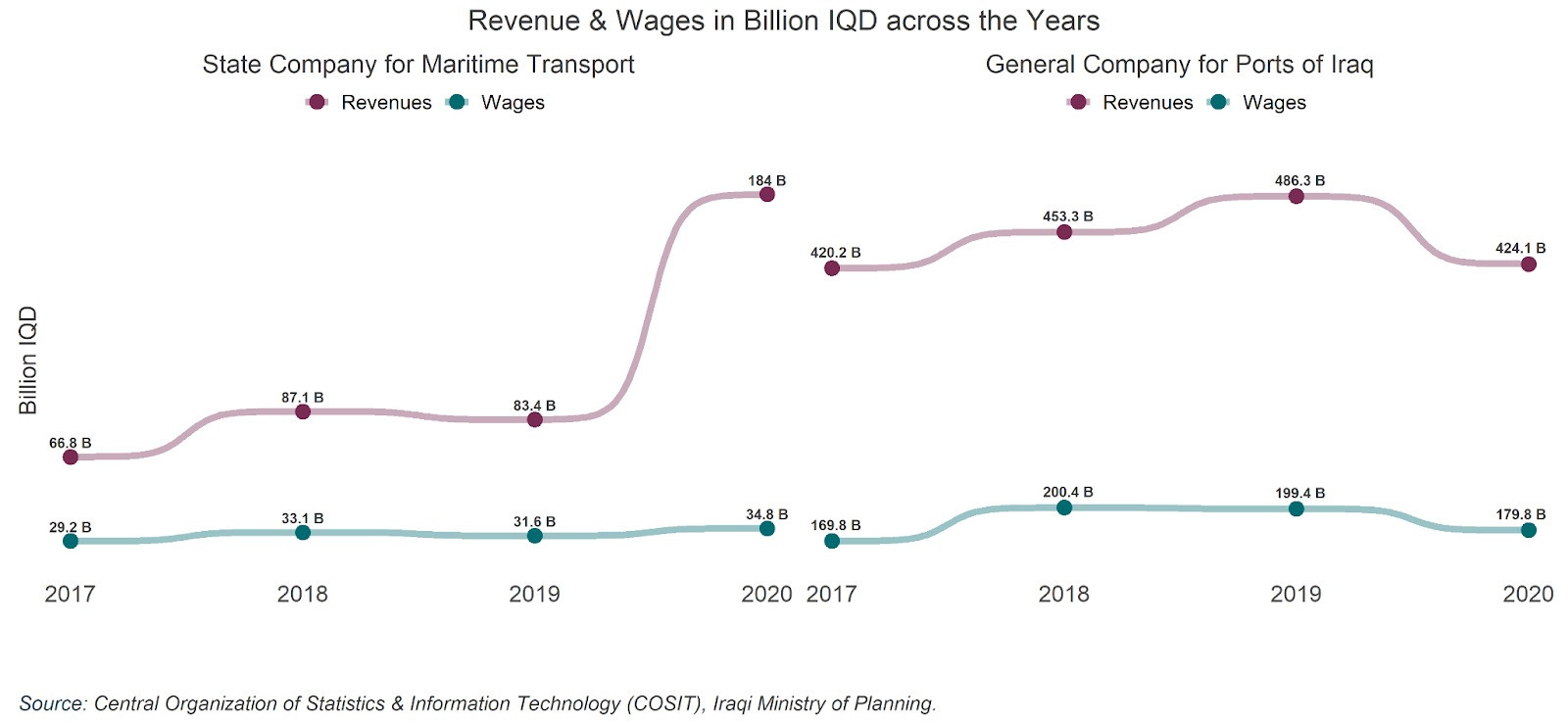

According to the Central Organization of Statistic and Information Technology, SCMT demonstrated a slight 4.2% decrease in revenues in 2019 from its previous year, attributable to the closure of Umm Qasr port for a period of time.

However, the 184 billion IQD revenues accumulated in 2020 is the largest amount of profit the State Company has amassed in years.

Additionally, total wages and benefits paid to the employees in the corresponding year witnessed around a 10% increase from 2019 owing to the dispensation of pensioners’ benefits and increasing incentives. On the other hand, GCPI exhibited a surge in revenues in 2019 and a subsequent decline in 2020, mainly due to the increase and decrease in Khor Al-Zubayr port’s oil cargo; this was in agreement with the British Petroleum company.

A total of 179.8 billion IQD in wages and benefits were paid to the employees of the General Company in 2020, an approximate 10% decrease from the 199.4 billion IQD paid in the year 2019 in correlation with the retirement of employees.

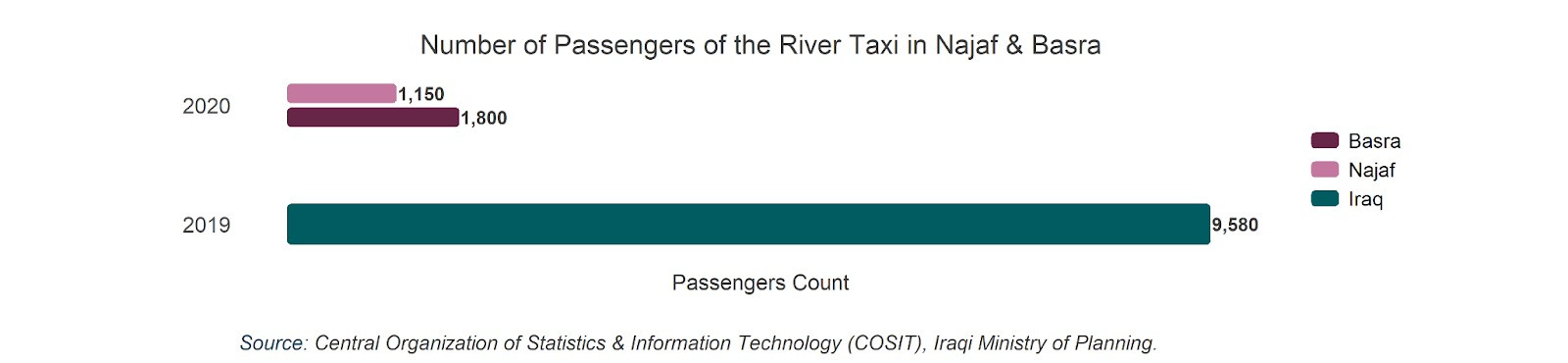

When it comes to the usage of river taxis as a local means of transportation in Iraq, it is mainly limited to the cities of Najaf and Basra. In 2020, approximately 3000 passengers used river taxis. Given the proper attention and resources, this number could be greatly enhanced if river taxis grow more available and accessible.

In Baghdad, where traffic congestion is at troubling levels due to its residents’ heavy reliance on private cars, taxis, and mini-buses; river taxis utilization can present the public with a quicker and cheaper alternative to cross the Tigris river, which cuts the capital into its two halves of Al-Karkh and Al-Rusafa shores.

Major Issues

Oil Dependence

Issues in the maritime sector arise with Iraq being one of the most oil-dependent countries in the world. The former Iraqi Minister of Finance, Mr. Ali Allawi, warns that Iraq's persistent reliance on oil as its main source of revenue could lead to an economic crisis within 5-10 years if not averted by diversifying the country’s exports, especially when there is a global incline towards renewable energy.

Corruption and the Lack of Security

It is also not surprising when the matter of corruption is brought forth in the transport sector. The General Company for Ports of Iraq operating under poor security measures, political interests and corruption interfere with the healthy functioning of the sector. This comes in the form of counterfeiting information of cargo arriving at the ports, forgery of official papers and documents, bribes to avoid customs and quality controls, as well as hiring employees based on political and tribal affiliations instead of qualifications and merit. All this ensues distrust in the management of maritime transport and deters investors from venturing into Iraq's economy.

Insufficient Funds

Another challenge that faces the sector is the limited financial budget allocated for maritime machinery and equipment such as ships, tankers, cranes, and excavators. This has left Iraq at the rear end of the maritime transport race when putting neighboring countries’ competition onto the scene. For instance, the aging fleet of 7 ships owned by Iraq’s State Company seems unambitious compared to Qatar’s 74 state-of-the-art vessels owned by Nakilat maritime company.

Failure to Conform with International Regulations

Furthermore, it is essential to touch on the fact that Iraq is not on the White List of the International Maritime Organization, a list of countries that comply with the Standards of Training, Certification, and Watchkeeping of Seafarers. Hence, additional sanctions are imposed on the already burdened maritime sector.

Recent Projects to Develop the Maritime Scene

Despite how challenging the situation might seem, the maritime sector is experiencing major developments to stimulate the industry and provide opportunities for investors to delve into. The opportunities that are worth mentioning are the following:

Al-Faw Grand Port

The Iraqi Ministry of Transport laid the foundation stone for the 6 billion USD Al-Faw Grand Port project in April 2010. The 2000 meters long berth and 39 thousand meters of core container terminal project would lie on the Gulf near the city of Basra. Expected revenues of the port are estimated to rise from 2.72 billion USD in 2022 to 6.9 billion USD in 2040. Al-Faw is deemed Iraq’s actual start for an economic renaissance and the largest port project in the Middle East with an annual absorptive capacity of 114 million tonnes at its final stage.

Construction of 13 Multipurpose Berths for Each of Umm Qasr and Khor Al-Zubayr Ports

Five hundred million USD were allocated for each port in plans to reduce the pressure on existing berths by increasing the capacity for loading and unloading goods. The expected additional annual capacities for the project are 3.75 million tons for Umm Qasr port and 4.25 million tons for Khor Al-Zubayr port. The project is also expected to cover all necessities of the new berths, such as equipment, services, roads, and railways.

Recommendations and Conclusion:

Years of neglect have left the Iraqi maritime sector with a multitude of issues. Still, with the upcoming reforms in the Iraqi government and the increasing awareness of the general public and their demands for change, a new era of development and growth in Iraq’s ecosystems is expected in the foreseeable future.

Some of the key recommendations that could enhance the maritime transport sector in Iraq include:

Implementation of up-to-date technologies in the operational systems of the ports to raise the efficiency and improve port facilities collectively, which will expedite processing times for cargos and administrative routines.

Upgrading the maritime fleet to keep pace with competing neighboring countries.

Aim to further minimize the maritime sector's corruption by integrating committed strategies and security protocols. Additionally, quality control measures should be of utmost importance to ensure the proper condition of goods entering the market.

Devise clear plans to attract investors into the Iraqi maritime scene.

Compliance to the international regulatory requirements and standards of conduct to lift sanctions and restrictions imposed on the sector.

Diversify the types of exports to reduce Iraq’s dependence on oil as its main source of revenue.