This report can be cited as:

KAPITA. "Iraqi Stock Exchange Market Overview And Sector Performance Analysis”. November 16, 2022. http://bit.ly/3An0GHV

Iraqi Stock Exchange Market Overview And Sector Performance Analysis

The Iraqi Stock Exchange (ISX) has seen turbulent times since its establishment in 2004. The ISX was initially modeled after the New York Stock Exchange (NYSE), not-for-profit and fully autonomous. In 2009 and 2019, ISX had technological assistance from NASDAQ, and switched to an electronic trading system (X-stream) and a central depository system, which allowed for online trading.

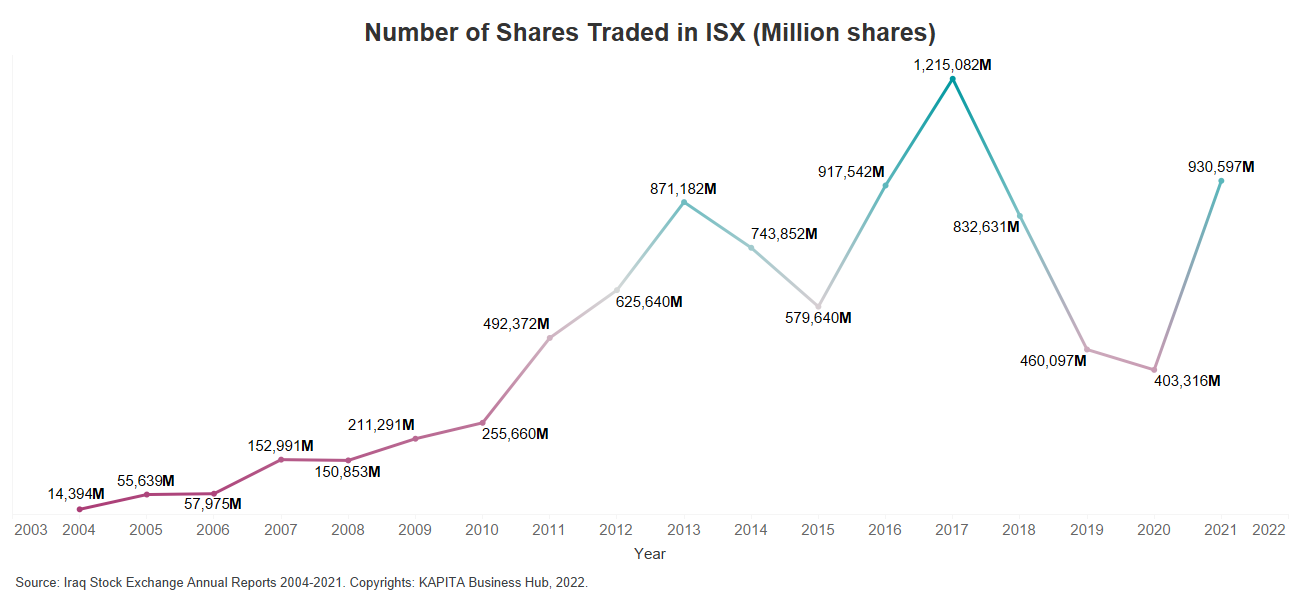

The number of shares traded in ISX has had its ups and downs. In 2013, shares traded spiked due to the AsiaCell initial public offering, the first telecommunications service provider to enter the ISX. Later in 2017, another spike was noted in the number of traded shares due to money transfer corporates entering the market.

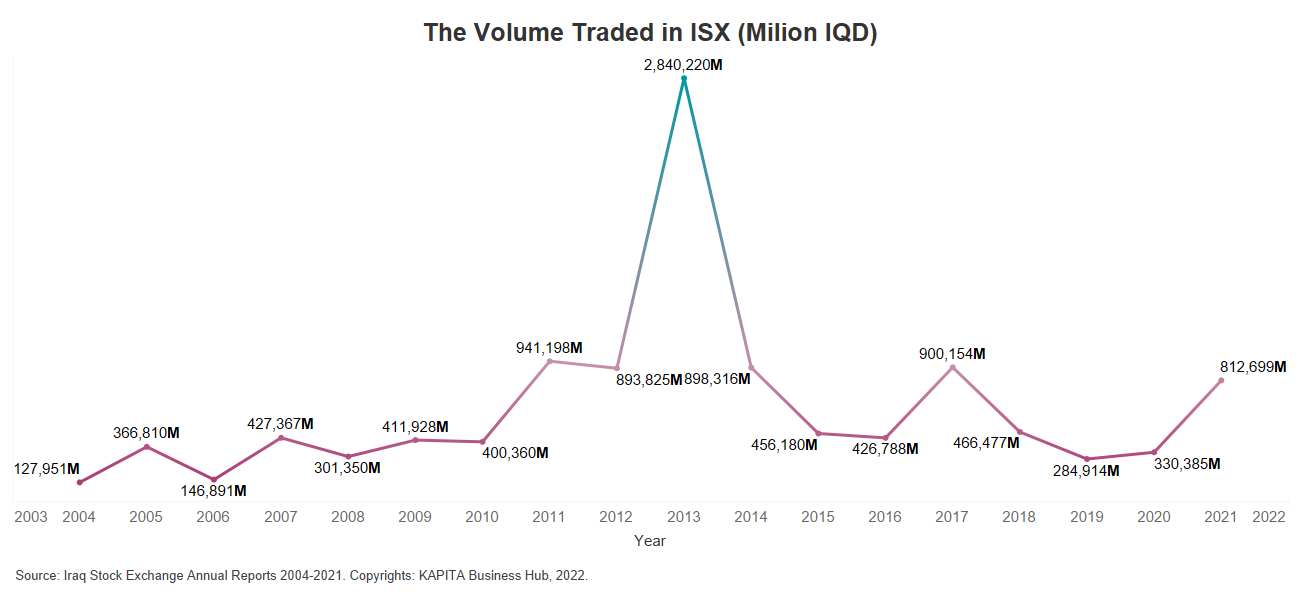

The COVID-19 pandemic affected the ISX market in 2020. Trading sessions dropped below 200 sessions for that year, and traded shares reached its lowest rate in over a decade, with only 403 million traded shares valuing around 330 IQD million.

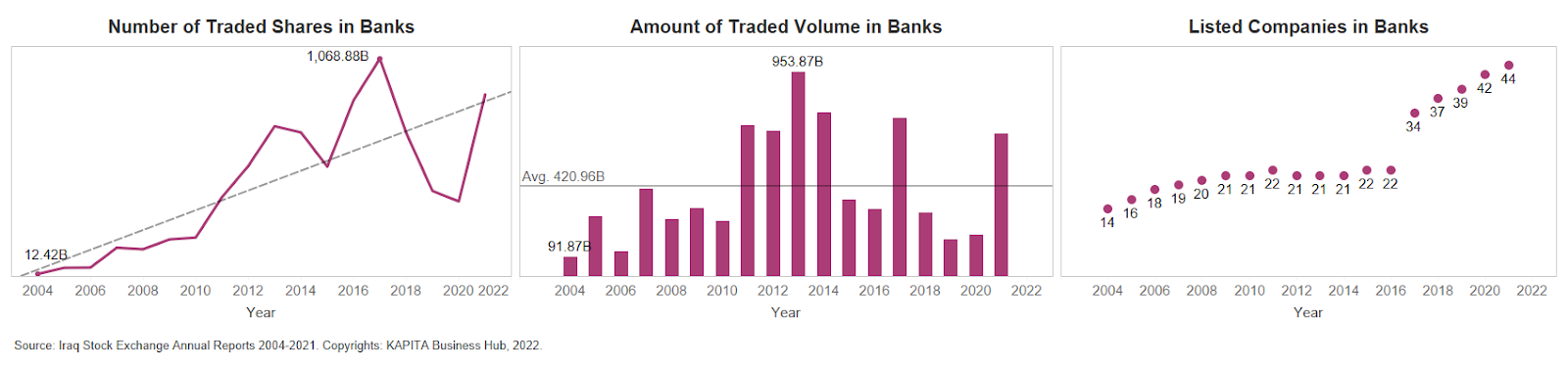

In this report we dive deep into each sector listed in the ISX. As an example in the following graph, we study the trend in the banking sector’s performance through the year in terms of the traded shares, the traded volume, and listed banks. We notice that the banking sector started modestly in 2004, with 12 billion traded shares that amounted to $91bn in traded volume for 14 listed banks.

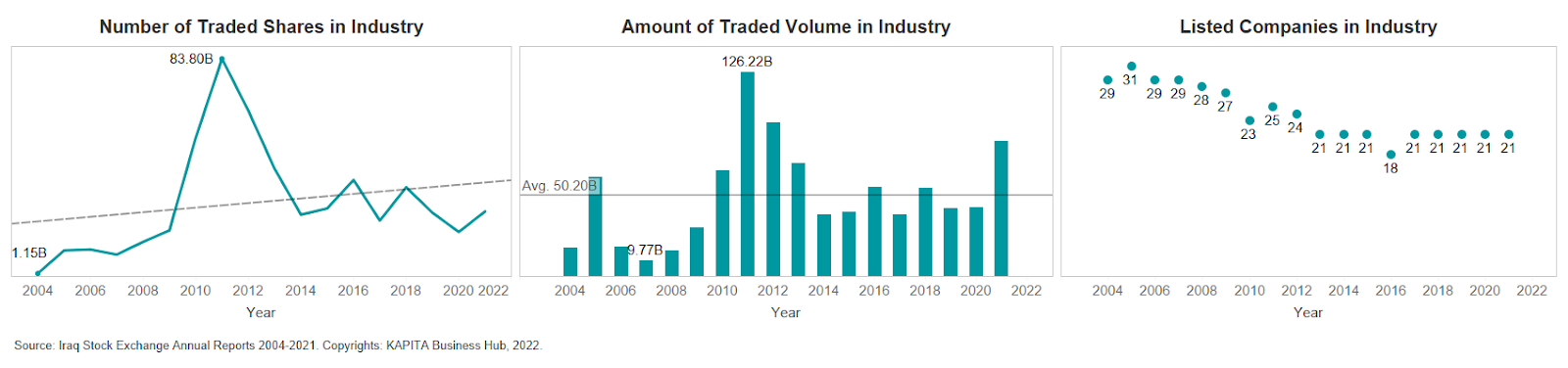

Contrary to the banking sector, the number of listed companies in the industry sector have been decreasing. The traded volume in 2021 was higher than it was in previous years due to the National Chemical and Plastic Company that was among the top 10 traded companies in 2021.

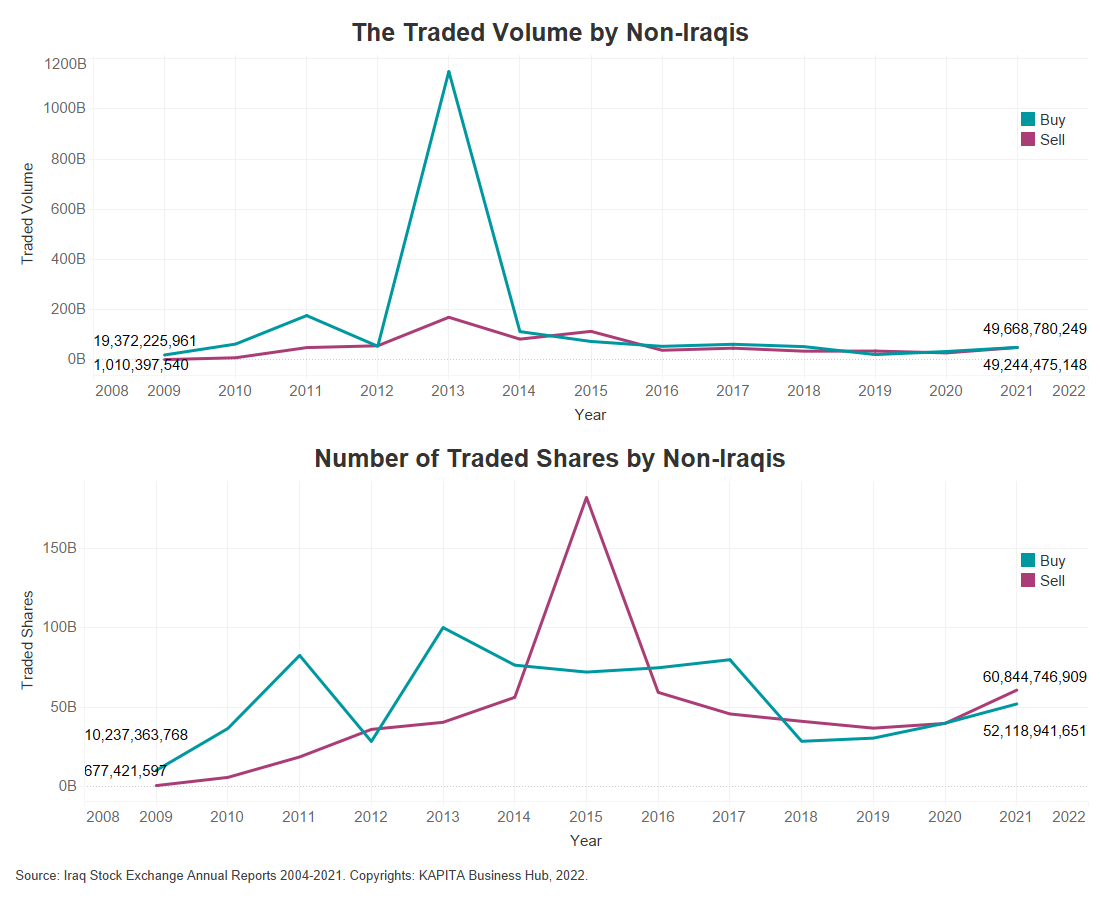

The ISX launched foreign exchange in 2007, which motivated investors to start trading in the promising Iraqi stock exchange market. The AsiaCell offering in 2013 was the main reason behind the peak in the traded volume.

The ISX is facing many hurdles that are hindering its growth. Reasons ranging from the lack of advanced technology to the corruption and lack of transparency in Iraq. The instability in Iraq has affected the ISX, causing a continuous deterioration in the ISX price index. In addition to the immaturity of Iraqi laws that cannot protect investors or companies listed in the ISX.

In this overview we present more data on the ISX; its status through the years, a comparison to other regional stock exchange markets, current issues, and finally, examples of trading companies in the ISX.

This report can be cited as:

KAPITA. "Iraqi Stock Exchange Market Overview And Sector Performance Analysis”. November 16, 2022. http://bit.ly/3An0GHV