The Iraqi Stock Exchange: Latest Trends and Performance

Aysegul Ozge Ozgur, SVP, Head of Research, Rabee Securities

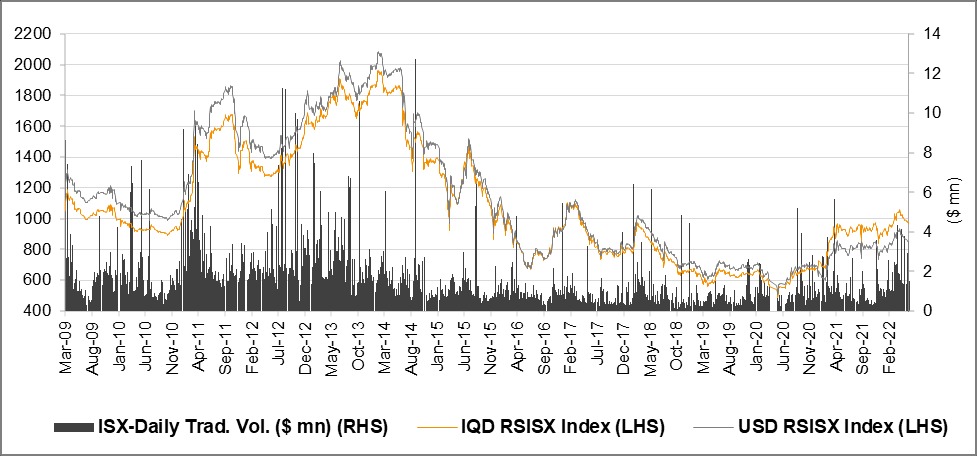

The Iraqi Stock Exchange (ISX) was established on 18 April 2004 and began trading with 59 companies. Among the milestones of the ISX are its opening to foreign investors in August 2007, the writing of the New Capital Market Law in 2008 which is still not passed, holding the first electronic trading session (NASDAQ /OMX) on 19 April 2009, and the increase of the trading sessions from three to five per week on the first of November 2009.

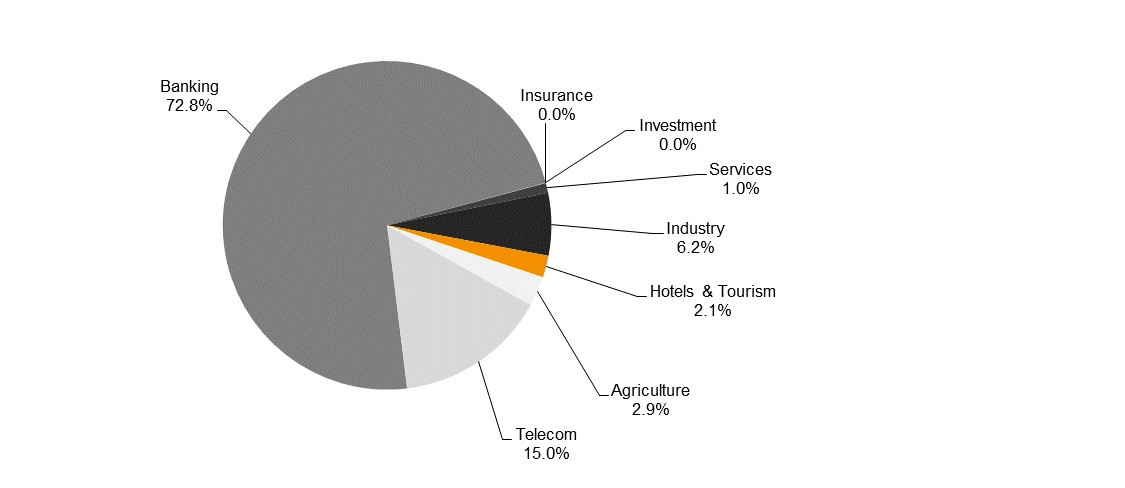

Today, 103 companies trade on the ISX, 40 of which trade on the non-regular market, with average daily trading volumes around $2.8 million per day, on a 12 months average. In the first four months of 2022, Iraq Stock Exchange’s (ISX) trading volume surged by 82%, compared to the same period of the previous year, to IQD265.3 billion. The banking sector had the highest share in trading volume with 72.8%, it witnessed a large volume of cross transactions. It was followed by the telecom sector with a 15.0% share. While the industry sector had only a 6.2% share, the agriculture sector had a 2.9% share, and the hotels and tourism had a 2.1% share. The remaining sectors had a 1.0% share in total trading volume.

Rabee Securities ISX Index (RSISX Index), which is a benchmark index in the market, increased by 8.2% this year to date, at the end of April 2022.

Thirty five companies’ share prices went up in the first four months of 2022 by the end of April, with Ishtar Hotels () increasing by 110%, followed by Al-Hilal Industries () +79%. Twenty three companies’ share prices dropped in the first four months of 2022, with Gulf Insurance and Reinsurance () declining 60%, followed by Sumer Commercial Bank () decreasing by 26%.

ISX Mcap is IQD16.3 trillion ($11.0 billion) divided into; banking sector (45.0%), telecom sector (42.4%), industry sector (7.2%), hotels & tourism sector (2.6%), agriculture sector (1.6%), services sector (1.0%), insurance sector (0.2%) and investment sector (0.02%).

ISX companies have traditionally high cash dividend distribution. Four companies decided to distribute profits during the first four months of 2022; Baghdad Soft Drinks Co ( yield: 5.3%), Trust International Islamic Bank ( yield: 2.9%), Baghdad Hotel ( yield: 3.2%) and Iraqi for Seed Production ( yield: 5.2%).

Breakdown of ISX Trading Volume by Sectors in the First 4 Months of 2022