Iraqi Startup Market: Unraveling the Untapped Opportunities

KAPITA’s Research Team

Report Summary

Overview

Many of the big businesses we know today were only ideas. Ideas that tackle real needs can become successful businesses if they are well invested in. Up-to-date Information and market knowledge can definitely be advantageous, especially in this rapidly progressing era when data is highly valuable and being informed can significantly increase a business’s success rate. As a result, gaining some understanding of the Iraqi entrepreneurial roadmap from different angles can definitely inspire new business ideas and contribute to the development of emerging startups. This report presents a roadmap that explores the Iraqi startup markets through the Iraqi demographics and GDP, ecosystem players, investment opportunities, private sector challenges, and market knowledge. The Iraqi market has witnessed a growth in opportunities, encouraging many ecosystem enablers to take part in the development of the private sector. This economic movement attracted local and foreign investment that facilitated access to finance for startups. Many startups have been initiated and grown with the help of ecosystem enablers and investment despite the challenges in the private sector environment.

Why Iraq

Population Demographic

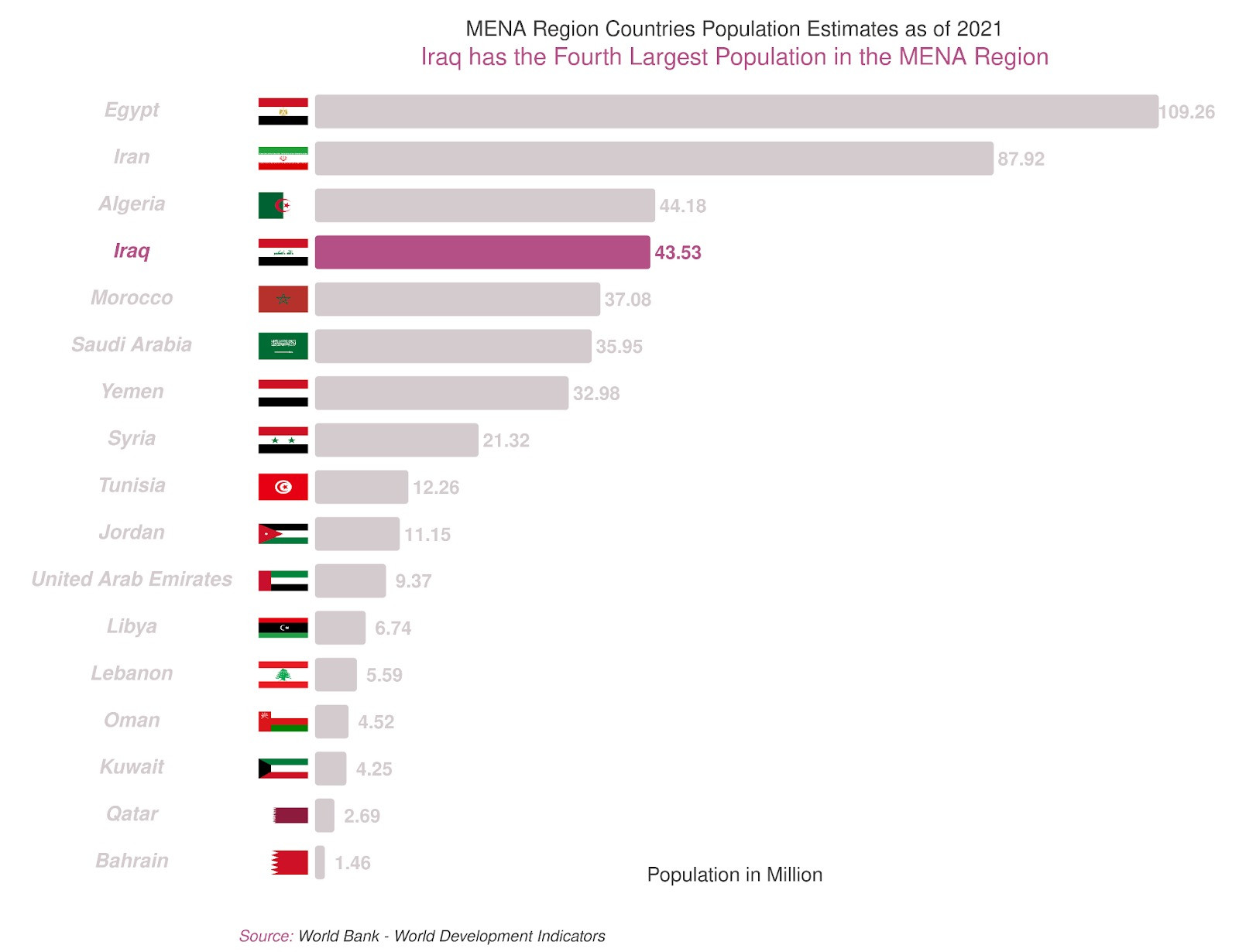

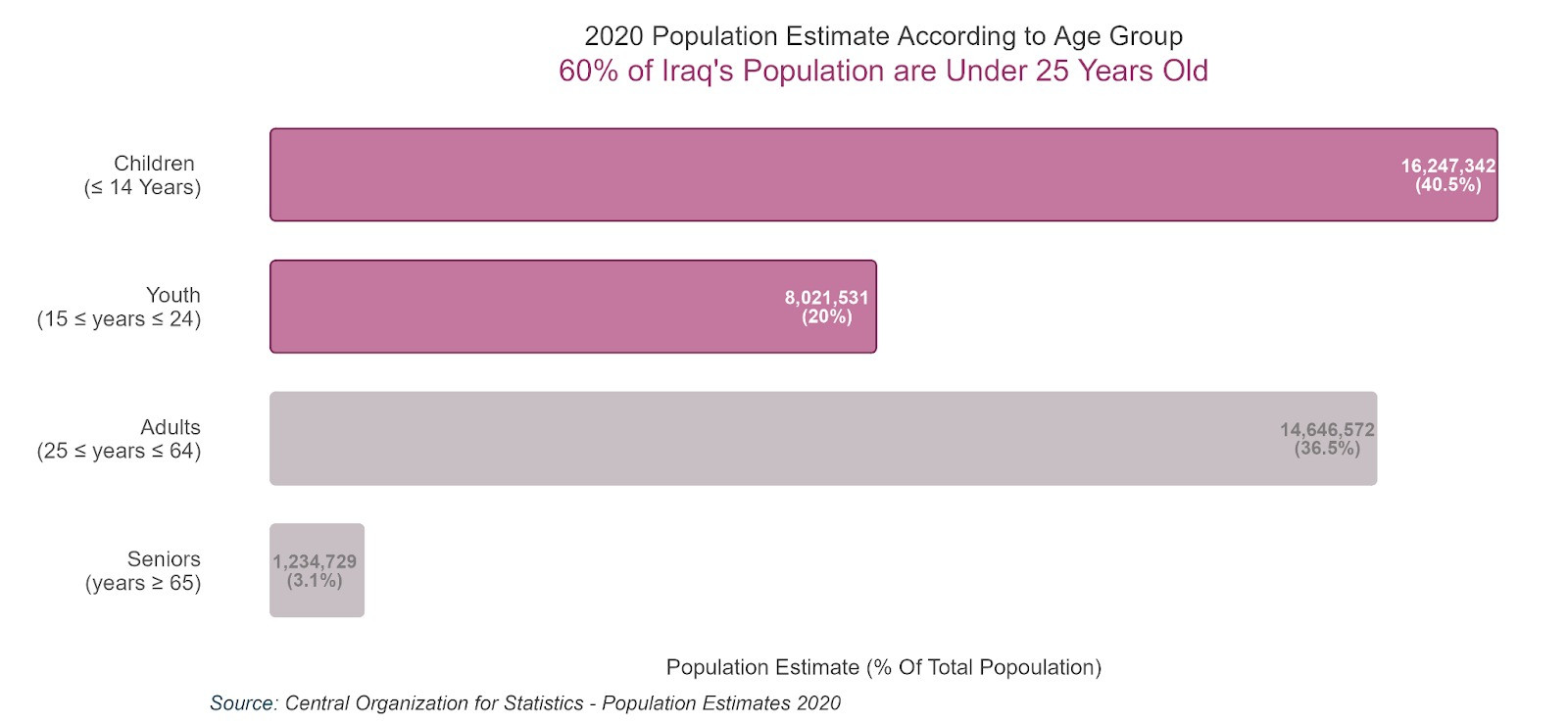

Iraq has the fourth largest population compared to the MENA region in general. The Iraqi population is estimated to be 43.5 million in 2021. The Central Statistical Organization of Iraq estimated that the Iraqi population will be 51.2 million by 2030. Iraq’s age groups fall into four categories: children, youth, adults, and seniors. The two dominant age groups are children and youth, which are estimated to make up 60% of the total population, while adults over 25 years old make up 36.5%.

Major urban governorates, such as Baghdad, Ninewa, and Basra, rank as the top three heavily populated areas, making up 39% of the total population. In contrast, the Iraqi remaining governorates’ populations range from 2% to 6%. Urban areas are more densely populated; 70% of Iraqis reside in urban areas, whereas 30% occupy rural areas.

Economic Indicators

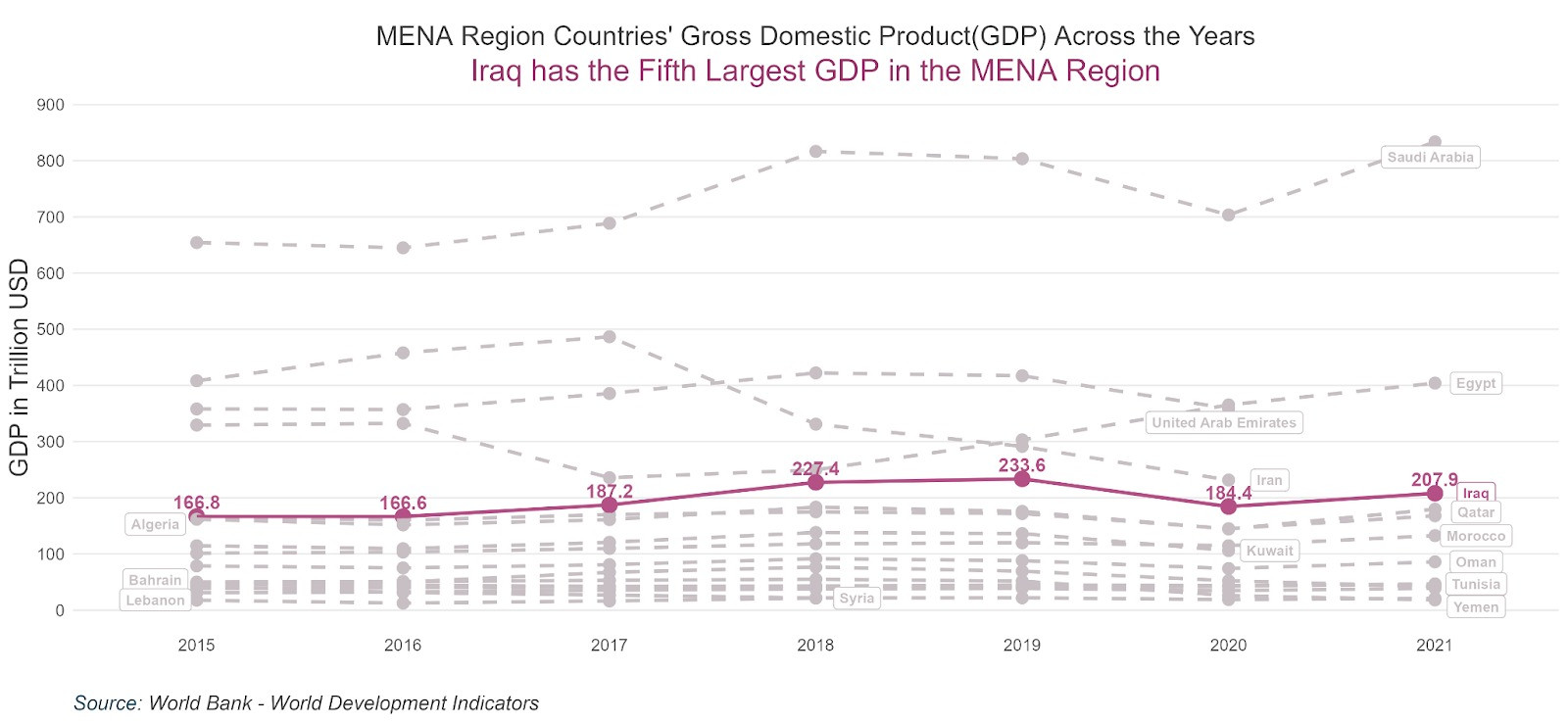

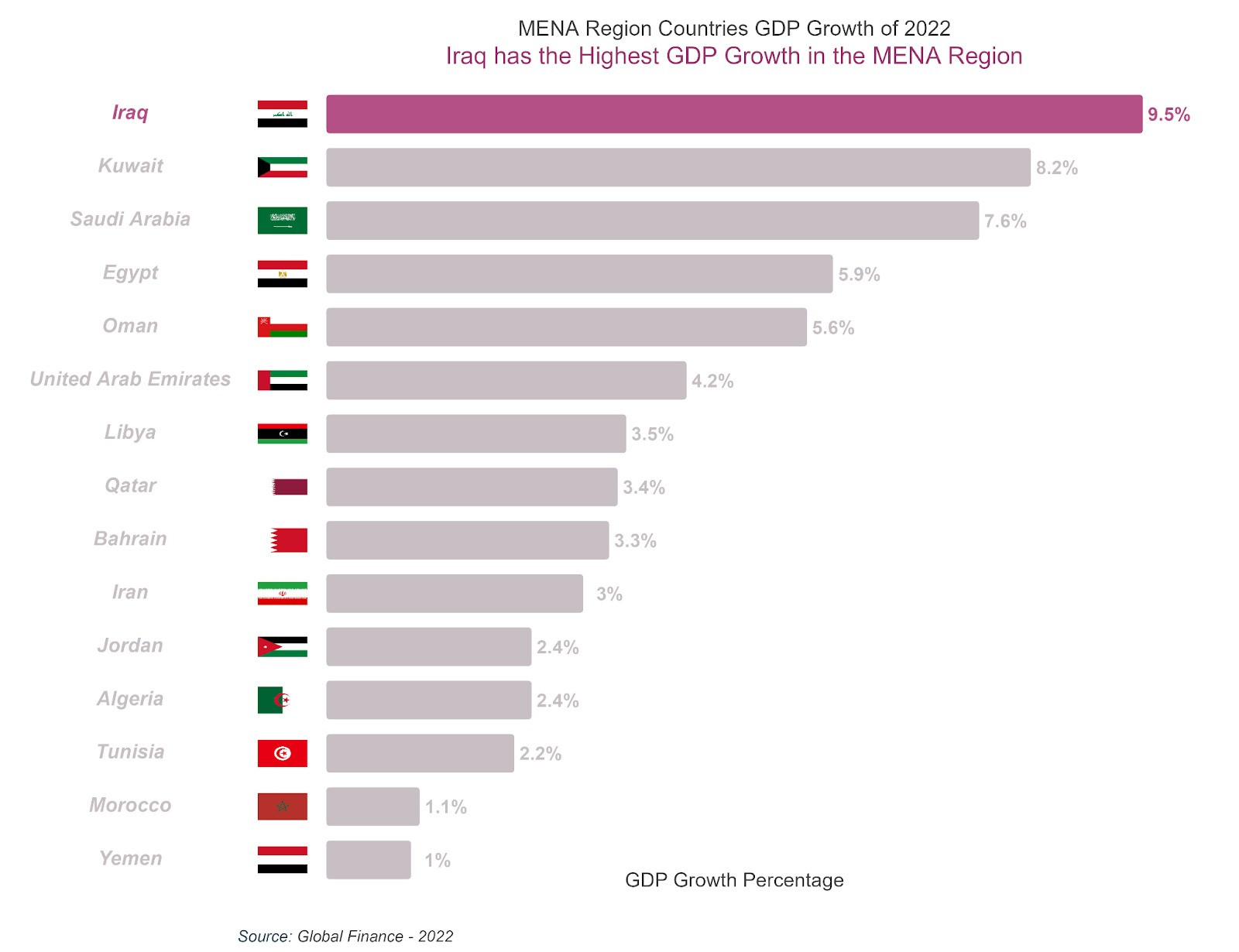

The increase in GDP over the past decades has made it the fifth-largest GDP among the MENA countries, according to the World Bank. Despite security challenges and COVID-19, the country has managed to overcome these crises.

The oil sector is the most predominant compared to the agricultural and industrial sectors, making economic growth subject to macroeconomic volatility. The country is still import-dependent. According to The Word Bank, 99% of exports are oil; Oil revenues account for 85% and 42% of the government’s budget and gross domestic product, respectively.

The contribution of agriculture to Iraq’s GDP decreased from 9% to 2% between 2002 and 2019. This reduction of agriculture has extended to many permanent and temporary crops, including wheat, as the average yield (kg/Dunam) declined from 727.6 in 2020 to 447.3 in 2021.

As for the industrial sector, the number of small industrial establishments has risen to 26247, adding 500 more establishments compared to 2018. Plus, the number of large industrial establishments has gone from 670 in 2018 to 719 in 2020.

Entrepreneurial Roadmap

Ecosystem Enablers

The nature of the Iraqi entrepreneurial ecosystem needs to be developed to create an environment where entrepreneurs can flourish and turn their ideas into startups, which will subsequently improve the reality of the Iraqi private sector. Therefore, many organizations, institutions, and training centers have managed to bring the startup scene into reality through the ecosystem enablers: startup boot camps, pre-incubations, incubations, acceleration programs, and co-working spaces. Some of these programs were financially empowered by a wide range of sources, such as GIZ, IOM, USAID, the French Ministry of Foreign Affairs, the Netherlands Embassy, and more.

Pre-incubation Programs:

The purpose of these programs is to enable innovative young entrepreneurs to transform their business ideas into viable products.

Ignite is a two-week-long pre-incubation program implemented by Five One Labs in Erbil and Basra. The training brings early-stage entrepreneurs together and teaches them the skills to determine whether or not their ideas are scalable. Sponsored by The US Department of State, Ignite delivers high-quality training and networking opportunities.

Moreover, The Station implements the Yanhad pre-incubation program and is funded by the European Union and the French Foreign Ministry. It consists of a series of critical thinking and problem-solving training for a better understanding of their startup ideas.

Incubation Programs:

Incubation programs are considered the cornerstone of the startup development ladder, where many players are taking the lead.

KAPITA, a private sector development company, offers The Orange Corners Baghdad incubation program (OC Baghdad). This program strives to reshape the Iraqi startup ecosystem through training, business development, events, coworking space, and investment.

In 2020, The Iraq Innovation Lab launched the Agri-Business Incubator. It supports local businesses, SMEs, and ideas aiming to create economic prosperity in the affected areas, including Salahadin, Ninawa, Diyala, and others. It focuses on early-stage startups, especially in the Iraqi agri-business sector, to create more economic prosperity and job opportunities.

In May 2021, The Station launched the Absher Incubation Program in Anbar, intending to support 10 SMEs surviving the remnants of COVID-19. The training includes mentoring sessions supervised by financial, marketing, and sales experts.

Five One Labs also has a three-month Startup Incubator, which targets 15 early-stage young entrepreneurs per cohort. The program provides real-world leadership, management techniques, and relevant business skills. Startup Bus is another entrepreneurial ecosystem incubation established by the UNDP Acceleration Lab.

Acceleration Programs:

Unlike incubations, acceleration programs are shorter in time and have growth-oriented training. Startups who aspire to scale up their businesses, overcome challenges, and increase profit can accelerate that through such programs.

Scale Up Academy, by KAPITA, is a nine-week acceleration program that targets startups. Throughout its duration, entrepreneurs gain knowledge in finance, marketing, advertisement, resource management, and business model refinement. The participants get to work with business development experts.

Takween Accelerator was founded in 2020 and is based at the American University of Iraq, Sulimani. Takween helps growth-stage and technology-enabled businesses. This online program provides intensive training programs, international mentorship, and access to investors and ecosystem partners.

Co-Working Spaces:

The Station built a Co-Working Space, which is an innovative working space that offers entrepreneurs access to high-speed internet, offices for meetings, and conference rooms. The objective is to provide startups with an environment of collaboration and cooperation to further their businesses.

Similarly, KAPITA opened up a co-working space in Baghdad named CoWork that offers co-working space and provides a professional environment and facilities for freelancers, entrepreneurs, and small businesses. The goal behind Cowork is to build a network of youth freelancers, business owners, and startups.

In June 2019, Field Ready launched a new Makerspace in Erbil, Kurdistan Region. Based in Re:coded House, Makerspace is an open space for events and courses, equipped with physical resources, such as CNC machines, 3D printers, laser-cutter, and many other related technologies.

Motives to Starting a Business

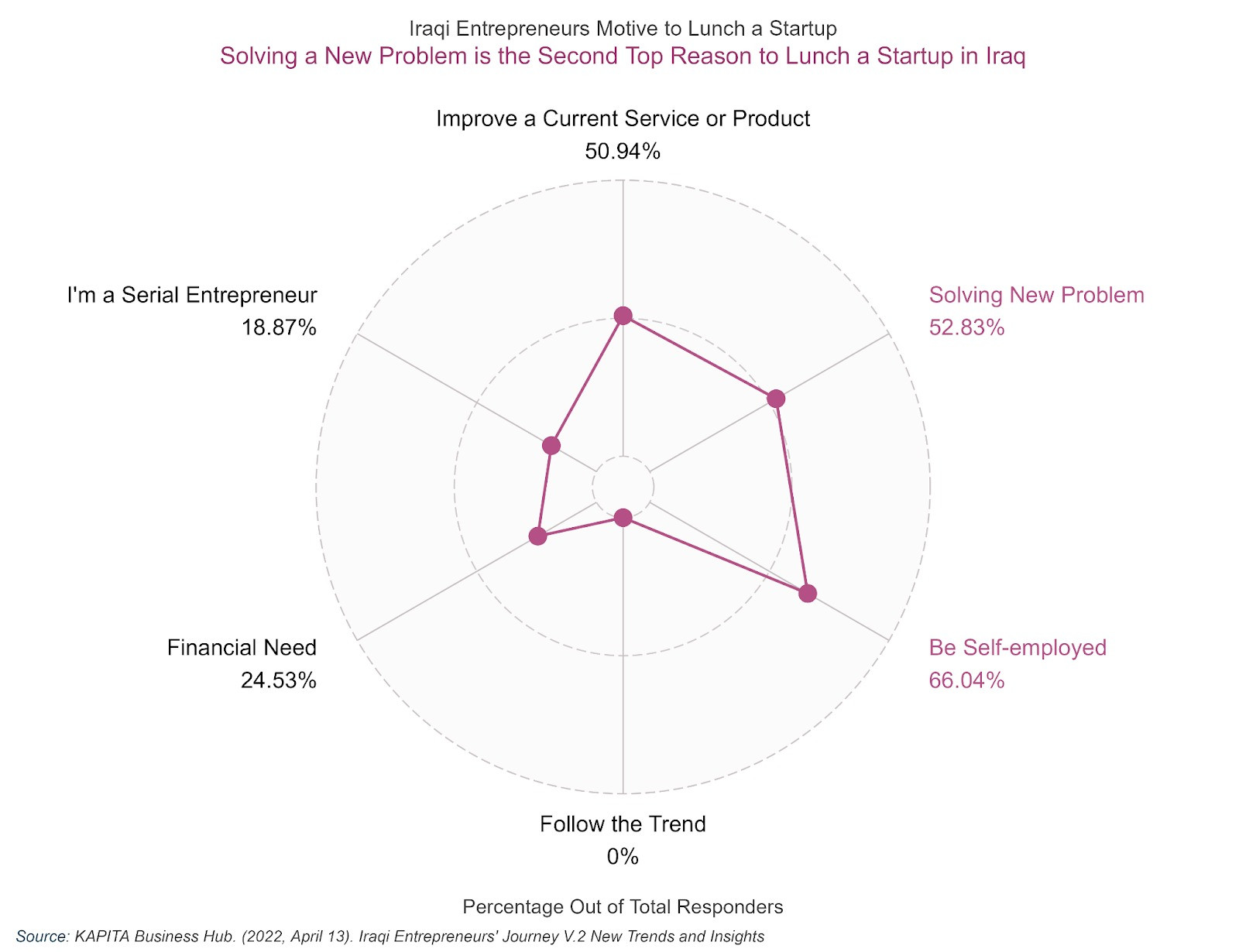

A typical Iraqi college graduate would expect a job/employment or start a business based on their educational background, yet research suggests that only 30.19% of startups are based in the same field of study, whereas 69.81% indicated otherwise. It also shows that self-employment is the most dominant motive to launch a startup in Iraq, while solving a new problem comes in second place.

Access to Finance

Investment Scene

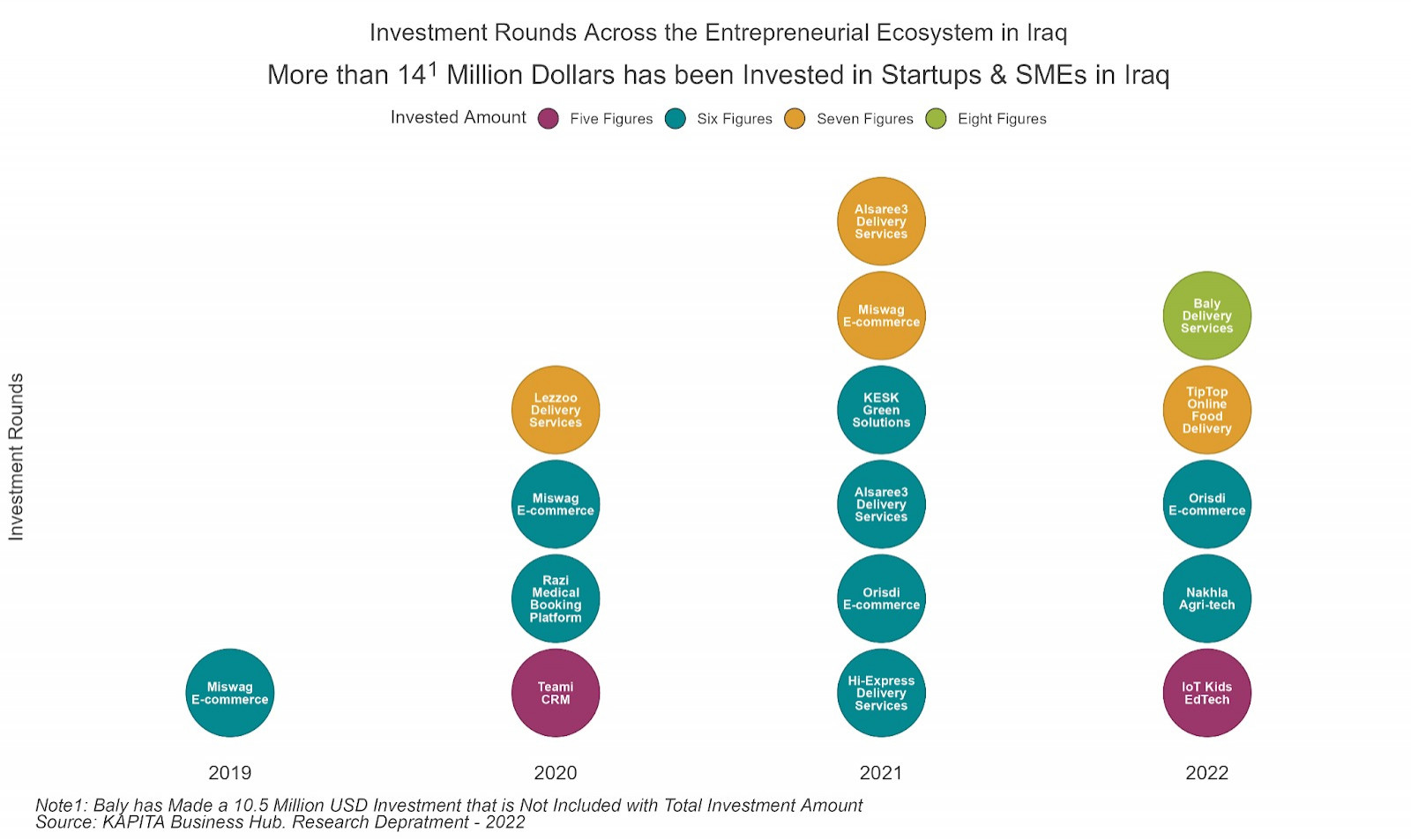

Investment Rounds

From 2018 onwards, the entrepreneurial ecosystem has experienced rapid investment growth. Fund rounds, either once or multiple times over an extended period in the form of rounds have been invested in several sectors. In the e-commerce sector, there are Miswag and Orisdi, while in delivery services, there are Alsaree3, Lezzoo, Baly, and more. Razi is a medical booking platform startup in the healthcare sector. Moreover, Iot-Kids, Nakhla, and KESK are examples of startups in education, agri-tech, and green solutions, respectively.

Investment Players

Many local/international investors and financial institutions have taken an interest in the Iraqi market because it is showing growth opportunities. Networks and ventures have been built and have established connections to secure a presence as a financial source and to take part in the development of the Iraqi ecosystem.

Iraqi Angel Investors Network (IAIN)

IAIN prides itself on being the first group of investors and businessmen in Iraq. IAIN aims to reshape the entrepreneurship ecosystem through investment and through a network that connects startups to local and international investors. Launched by KAPITA, IAIN has over 37 local and foreign investors. IAIN invests in early-stage businesses, especially in the seed stage. The network has raised $1 million worth of investment targeting various markets.

Euphrates Iraq Fund

Established in 2010, Euphrates Iraq Fund Ltd is a specialized hedge fund based in the USA. In 2021, the Euphrates Iraq Fund, in partnership with other investors, launched the Euphrates Venture Capital Fund to invest in emerging startups and SMEs across Iraq and the Kurdistan Region.

Iraq Tech Ventures

ITV is a venture capital investment firm based in the UAE. ITV’s main field of interest is the seed development stage investment targeting tech industries like e-commerce and delivery services.

Iraq Venture Partners

Iraqi Venture Partners is an Iraqi-based early-stage fund. Established in 2021, the venture comprises a partnership of Omar Al-Handal of The Station, Mohammed Khudairi of Iraq Tech Venture, and Bassam Falah of Innovest ME. This partnership primarily aims at startups and SMEs across all industries.

Northern Gulf Partners

North Gulf Partners is another specialized investment firm with remarkable records in investment and advisory in Iraq and across the MENA region. Established in 2008, NGP acts as a primary bridge connecting Iraqi growth-driven businesses to leading investors. In 2019, NGP provided Lezzoo with a $1 million worth of seed investment.

Loans & Grants

Orange Corners Innovation Funds (OCIF)

OCIF is a 1 million Euro fund designated to Orange Corners Baghdad. The objective of this subsidy program is to allow entrepreneurs and startups access to financial support. OCIF has two tracks. First is 320 euros of monthly allowance and 2400 euros voucher. The second track is a 27.5 thousand euro divided into two equal parts; the first part is as a grant, whereas the second part is a zero-interest loan given to Orange Corners Baghdad graduates.

Tamwil

Tamwil is a funding initiative of the Prime Minister’s office and CBI for startups and SMEs. It also comprises the Agricultural Bank and the Private Banks League. The loan is a total of 5 trillion IQD granted to a wide range of projects: industrial, Agricultural, housing, and recently added renewable energy. The goal is to drive economic growth and create business opportunities.

The Nomou Iraq Fund (NIF)

This program is managed by GroFin to assist young entrepreneurs, startups, and SMEs. The program establishes a long-term commitment with entrepreneurs who already have established businesses. The Business should meet certain requirements to be eligible to receive a medium-term loan ranging from US$ 100k to US$ 2m. The NIF covers different sectors, including education, healthcare, agri-processing, manufacturing, Energy Waste, Water, and Recycling.

Northern Iraq Investment (NII)

It is a program by GroFin offering funds and technical support to SMEs in the northern part of Iraq. One of the important funds implemented is the NII COVID-19 SME Support Program, which provides businesses with a short-term loan between US$ 10k and US$ 100k with a convenient interest rate.

CHF Vitas Iraq

It is a nonprofit institution founded in 2003 and has 14 branches in Iraq. CHF Vitas Iraq provides two types of loans. It offers microloans ranging from $100 to $19,999 for micro businesses and small loans from US$ 20,000 to US$ 35,000 with a convenient loan payback duration.

Private Sector Challenges

Limited Access to Finance

Access to finance is a huge endeavor in Iraq. There are many reasons why

micro, small, and medium-sized enterprises have limited financial access. A 2021 survey, by the Iraqi Ministry of Planning, UNDP, and USAID on MSMEs to address the national economy and how to activate the private sector. The survey covers 2017 MSMEs in Baghdad, Basra, and Mosul. The numbers show that the main source of financing, up to 70%, comes from personal savings or family/friend loans, whereas bank loans make up only 11%. Also, the percentage of those who tried to obtain financing but were not successful was 30%. Fifty-five percent of responses stated difficulty in finding a financier, costly financing teams of interest rates, and provision of guarantees. Judging from these numbers, there is a huge funding gap in the market, with high demand for finance and low supply from the banking side. The survey highlights common reasons for financing, which are business expansion and equipment modernization for 70% of respondents.

Poor Banking Infrastructure

Significant Gap in Financial Inclusion

The Iraqi economy could not have the opportunity to develop a modern banking system with efficient financial services to be systematically financially inclusive.

For a long time, the Iraqi economy could not have the opportunity to develop a modern banking system with efficient financial services to be financially inclusive, which is defined by The World Bank as “individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, and insurance – delivered in a responsible and sustainable way.”

Lack of Banking Services

It has been challenging to introduce the internet element into the banking system despite reform attempts to digitize financial services and enable banking services. People still use cash for daily economic activities rather than electronic cards.

Banking solutions are lagging behind. The number of POCs, POSs, and ATMs was 13,794, 7,540, and 1340 in 2020, respectively. The latter witnessed an increase of only 226 ATMs by the following year.

Laws & Regulations

Challenges to Start & Scaleup

Besides the difficulty of obtaining financing and poor banking services, the private sector faces challenges associated with laws and regulations regarding business registration. Businesses find it overwhelming and time-consuming to go formal. The United Nations Development Program points out that 39.1% of MSMEs lack information about the registration processes, while the other 9.9% had concerns about the reporting requirements that would result from the registration. Therefore, the number of MSMEs neither registered nor have the incentives to be in the formal economy is high.

Foreign Investment Challenges

Investment Limitations

The private sector has also been stranded in a limited pool of investment opportunities despite witnessing an increase in international interest in the Iraqi ecosystem. Foreign investment still faces challenges in the form of laws and regulations: Company Law No. 21 of 1997, amended in 2004, and the introduction of foreign ownership restriction in 2017. It establishes that foreign ownership in Iraqi companies is 49%.

Stability and Security

Investors shy away from the Iraqi economic market due to the lack of social and political factors that allow for a suitable environment. Years of conflicts and political instability have not been presenting the Iraqi economy as a go-to opportunity to the outside world.

IT-illiteracy & Tedious Investment Procedures

Information technology is a must and the foundation for companies worldwide to operate. Iraq is still lagging when it comes to IT infrastructure and communication, which facilitate communication and ease starting investment processes among the government’s institutions. The incorporation of modern technologies incentivizes investors and attracts more foreign capital into the economy.