Iraqi Entrepreneurs Journey V.2 New Trends and Insights

KAPITA’s Research Team

Research Summary

The Iraqi entrepreneurial landscape has been evolving over the last two years, withstanding, and sometimes overcoming, national and international challenges. The COVID-19 pandemic has affected global economies at large, including Iraq. While the increase in the exchange rate of the United States Dollar (USD) to the Iraqi Dinar (IQD) has affected the national economy. These incidents cast a shadow over the entrepreneurial journey in Iraq, yet, there are always opportunities that could be captured amidst the uncertainty.

This research is an updated, quantitative assessment of the Iraqi Entrepreneurs Journey: An In-Depth Analysis that was published by KAPITA in July, 2020, which was the backbone to understanding the problems, solutions, opportunities, and challenges that entrepreneurs face in the Iraqi business ecosystem. Two years later, we are providing an updated, yet in itself, a new version to complement the previous findings with current insights. To understand the characteristics of the Iraqi entrepreneurial world and provide the stakeholders, investors, researchers, and casual onlookers a detailed and straightforward picture of the advances within that world.

Characteristics of Entrepreneurs

Age, Gender, and Number of Founders

The majority of founders were individual founders amounting to 60% of the respondents, the rest were between 2-3 founders and a minority of 3-5 founders. When it came to gender, women were underrepresented, with only 24.5% of founders. This might be due to several reasons, including social constraints, lack of technical and financial resources, and lack of available online data that could be vital to their understanding of the market, amongst other issues.

Academic Background and Its Impact on the Startup

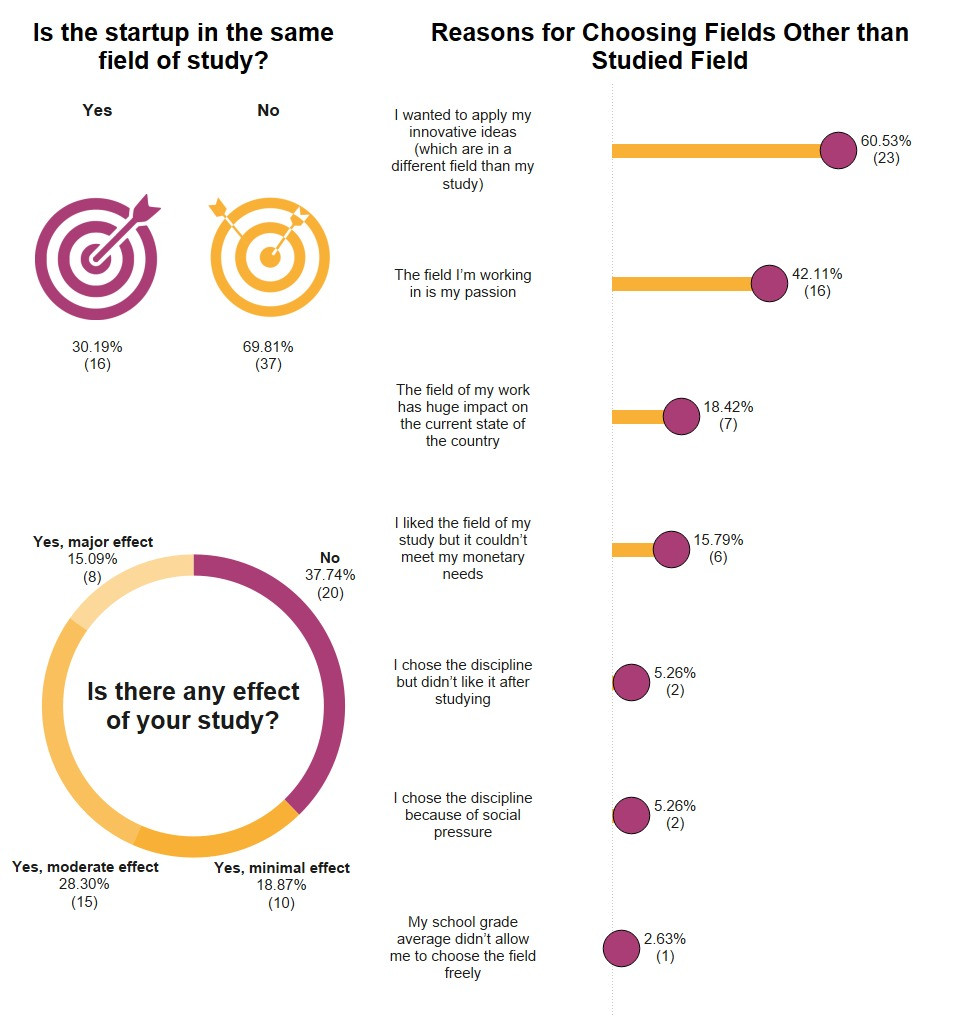

The current findings indicated that the vast majority of founders were working in a field unrelated to their studying field. The majority of respondents who answered that their field of study was not the same field that they found their startup in, claimed that “[they] wanted to apply [their] innovative ideas (which are in a different field than [their] study)” as the reason for them to start their business in a different field.

Most respondents said that their academic study did not affect their startup (37.74%), while the rest answered that it had a moderate (28.3%), minimal (18.87%), and major effect (15.09%) on their startups, respectively. This can also denote an issue in regards to entrepreneurial education within the educational system.

Sources of Knowledge

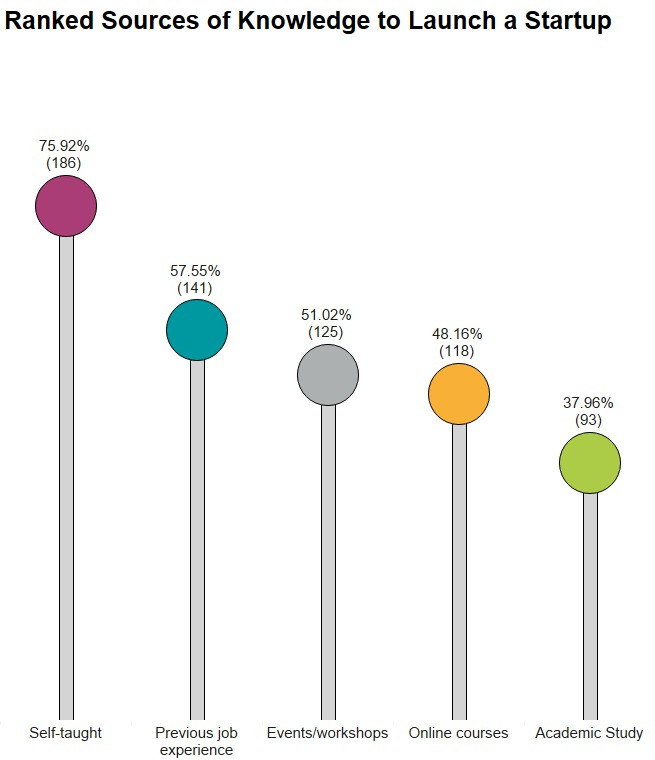

The versatility of sources of knowledge leads to the development of skills and mindset that help in understanding the market, the customer, and the product much better than being limited to a single source. Academic education is expected to be a pillar in developing the skills to launch a startup. However, the current findings indicated that academic study was ranked fifth as a source of knowledge while self-teaching was ranked first and previous job experience as second in level of importance to respondents, followed by events/workshops third and online courses fourth.

Dedication to Startup

Around 62% of the respondents stated that they have another job other than their startups. This is an international phenomenon within the context of entrepreneurship known as hybrid entrepreneurship. This term could be defined as the process of initiating a business while simultaneously remaining employed for wages. Hybrid entrepreneurship allows individuals to start a business on a smaller scale which enables individuals to learn more about their venture and reduce risk. However, on the negative side of hybrid entrepreneurship, it undermines the scalability and growth of the business and also the pace at which the business is expanding.

Entrepreneurship

Motives to Launch Startups

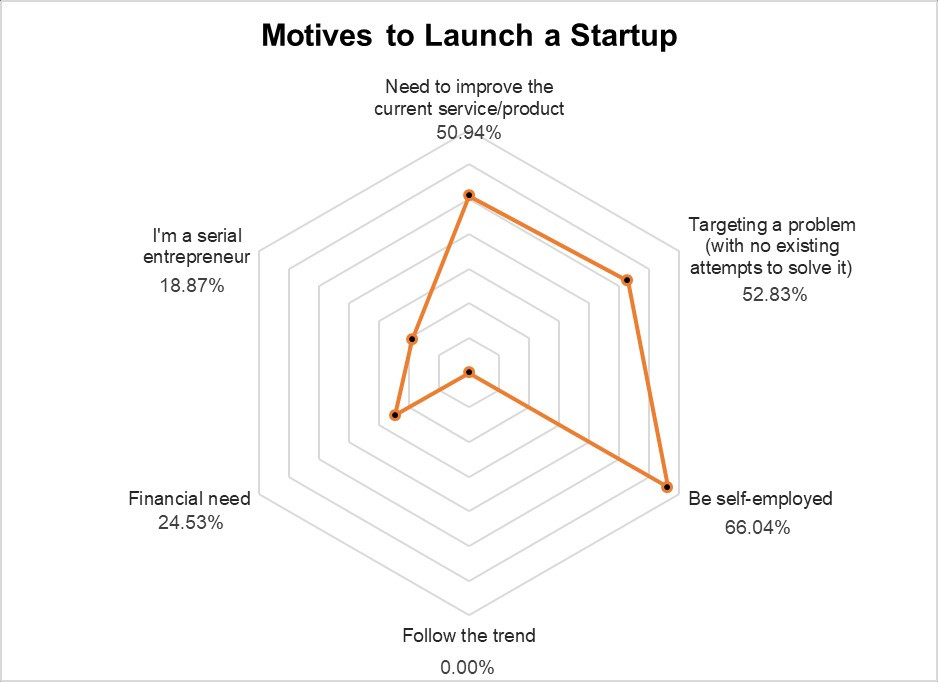

The survey found that the majority of founders chose to be self-employed as their main motive for launching their startup. Targeting a problem (with no existing attempts to solve it) was the second most chosen motive, and the need to improve the current service/product was the third most chosen motive.

Types of Startups

In the previous research, retail startups formed the majority, followed by e-commerce and management software startups. The scene has since changed; in the current research, e-commerce startups took the lead while management software startups took the 4th place and retail startups took the 7th place. These differences can be attributed to several factors, including increased interest in e-commerce in Iraq, retail startups being more established now, and sampling differences between the previous and current research, as the current research is more inclusive than the previous one. On the same token, agriculture-related startups are on the rise, which indicates an increasing interest in a very important sector in Iraq.

Channels and Ownership

Having both online and offline channels still dominated the scene of startups, with 49.06% having both. But the gap with online-only startups has been reduced as more startups (than in the previous research) reported an online-only channel, with 47.17% of the respondents reported having an online-only presence. This could be attributed to the young nature of the current startups and could be a potential response to the COVID-19 pandemic. In contrast, current findings indicate a rise in single-owned startups compared to previous research.

Developing Ideas and Testing Methods

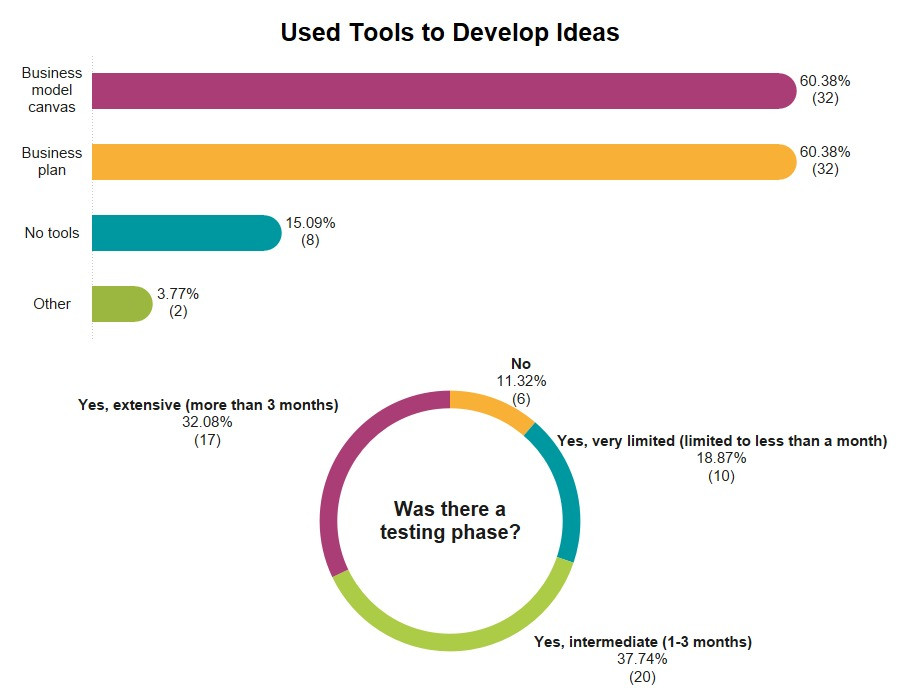

The current findings are hopeful as most entrepreneurs used one tool or another to develop their ideas, and almost 90% of them run a testing phase to a variable extent. While in the previous research, around 39.02% did not use any tools, 29.27% used a business model canvas, and 26.83% used a business plan. This might be due to the increasing number of support organizations since 2020, which helped businesses follow a more comprehensive planning phase. There has been an introduction of 3 pre-incubation programs, 10 incubators, 5 accelerators, and 2 competitions. In addition to that, investments became more accessible and normalized with 6 companies/organizations being part of the ecosystem, pre and after 2020.

Teamwork

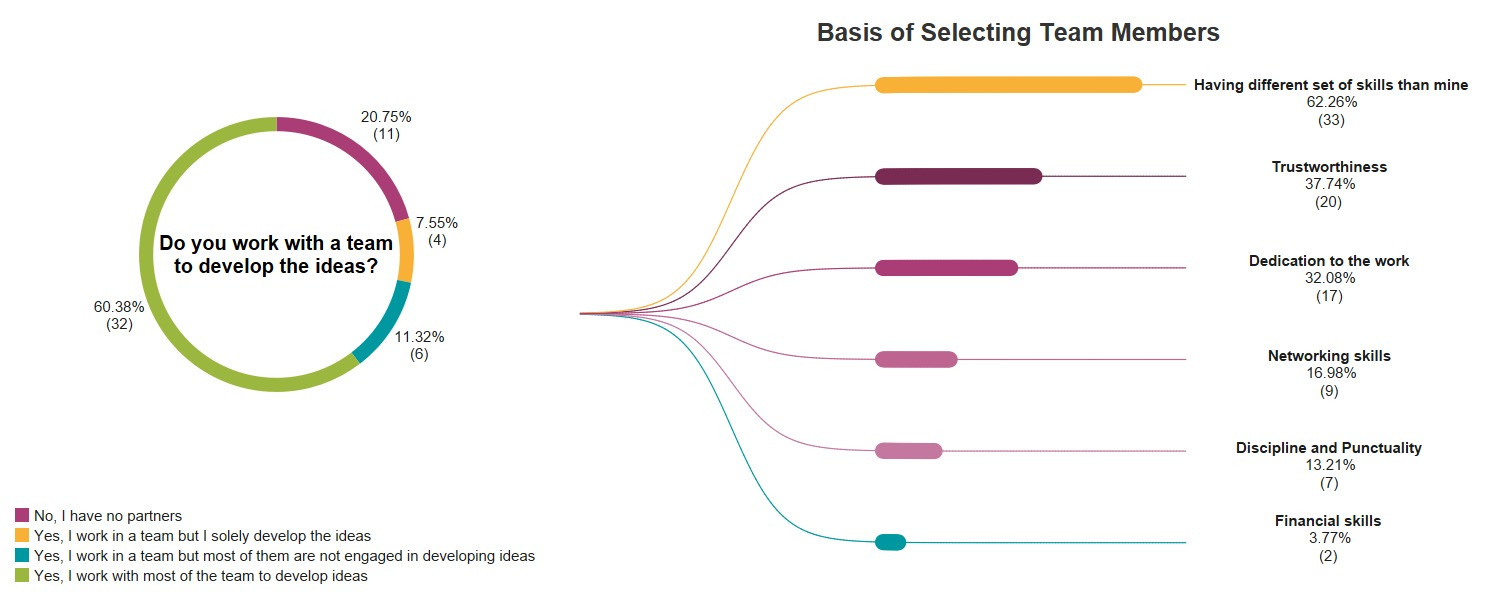

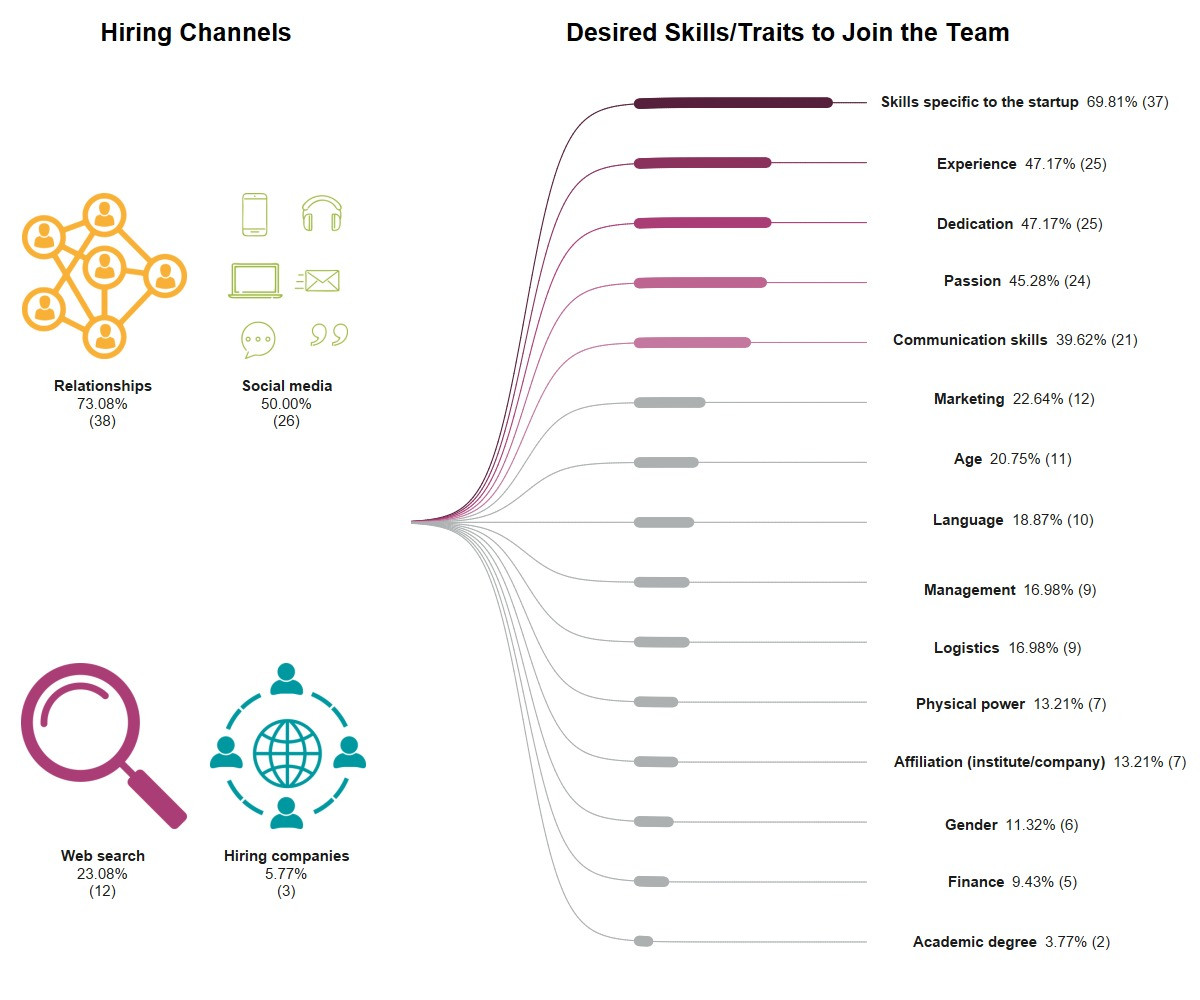

Working with Teams and Basis of Selection

Building a team is one of the most important aspects of building a successful business that is able to thrive and be sustainable. A team will be the one responsible for most of the day-to-day operations of the startup. There are many aspects to selecting the team. Most international trends view trustworthy team members as a major aspect of hiring. Our surveyed founders have chosen trustworthiness as their second most important basis for selecting team members, only proceeded by having different skills than the founders.

Building Teams

Around 73% of the surveyed founders choose relationships as their main hiring channel.

This is an indication that the Iraqi market is mainly based on networks. It emphasizes their importance and denotes the cultural aspects that come into play when building a team. As mentioned previously, the importance of trustworthiness ties neatly with professional networking.

Registration

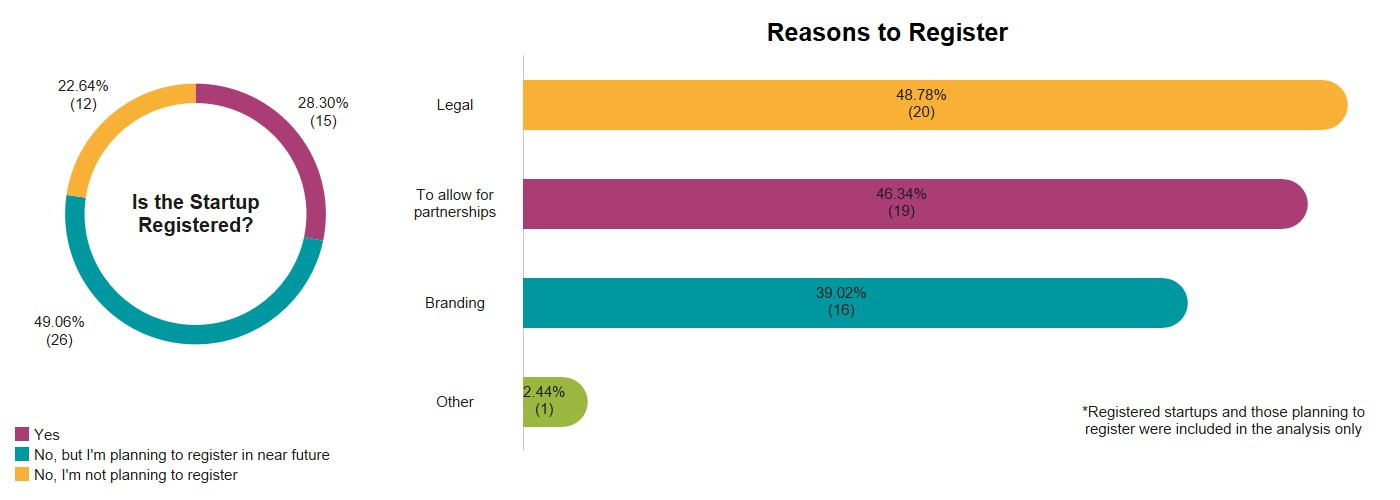

Current State, Reasons to Register, and Challenges

Registration is a procedure that any company has to go through in order to operate legally within Iraq. It is legally defined as “the process by which a company gets listed in the Registrar of Companies - Chamber of Commerce in order to finalize the establishment process, which grants it a separate legal entity. This enables companies to freely practice all economic activities as well as subjecting it to all the country’s laws in force.” There are many benefits to registering a company, including, but not limited to, preventing intellectual theft of the brand name, partnerships with companies and banks, obtaining a license to establish a company’s headquarters, and having more credibility to acquire customers. However, only 28.30% of respondents have registered their startups. When identifying the challenges of registration, around 58.5% of respondents attributed the challenges to the long process, 52% to the cost, and 41.5% to the taxes. It is noteworthy that respondents were allowed to state multiple challenges.

Customers and Market

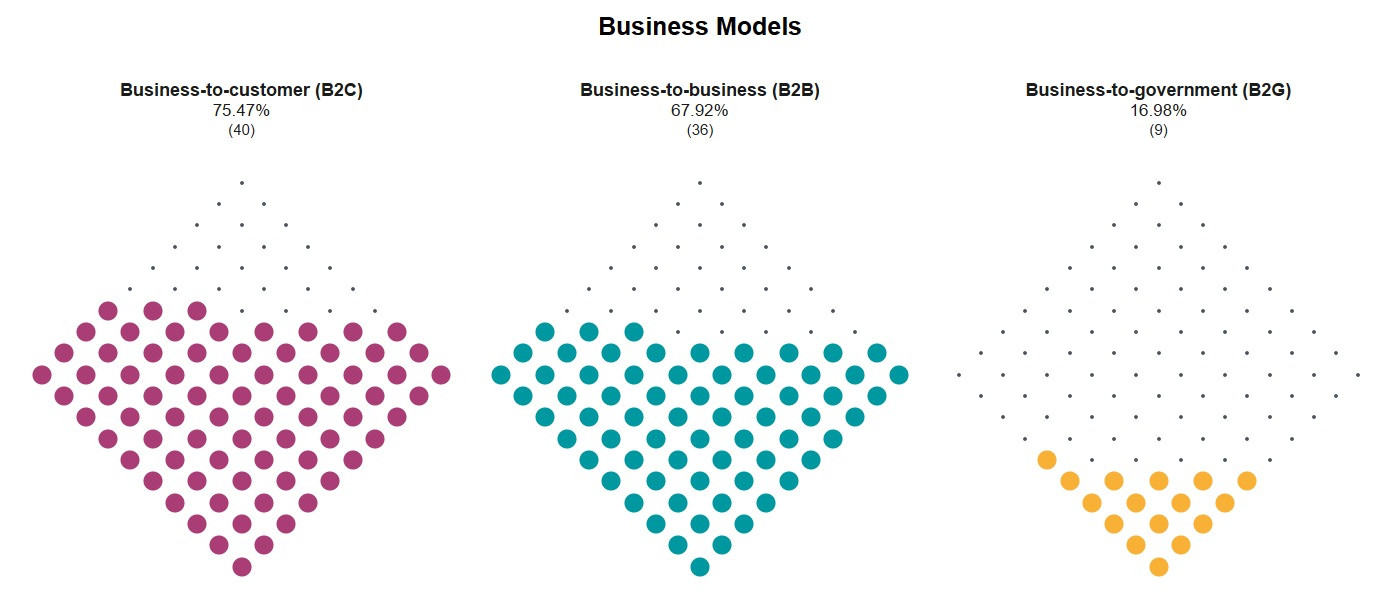

Business Models

The survey findings indicate that the focus of business is mostly on customers (75.47%) followed by other businesses (67.92%), then the government (16.98%).

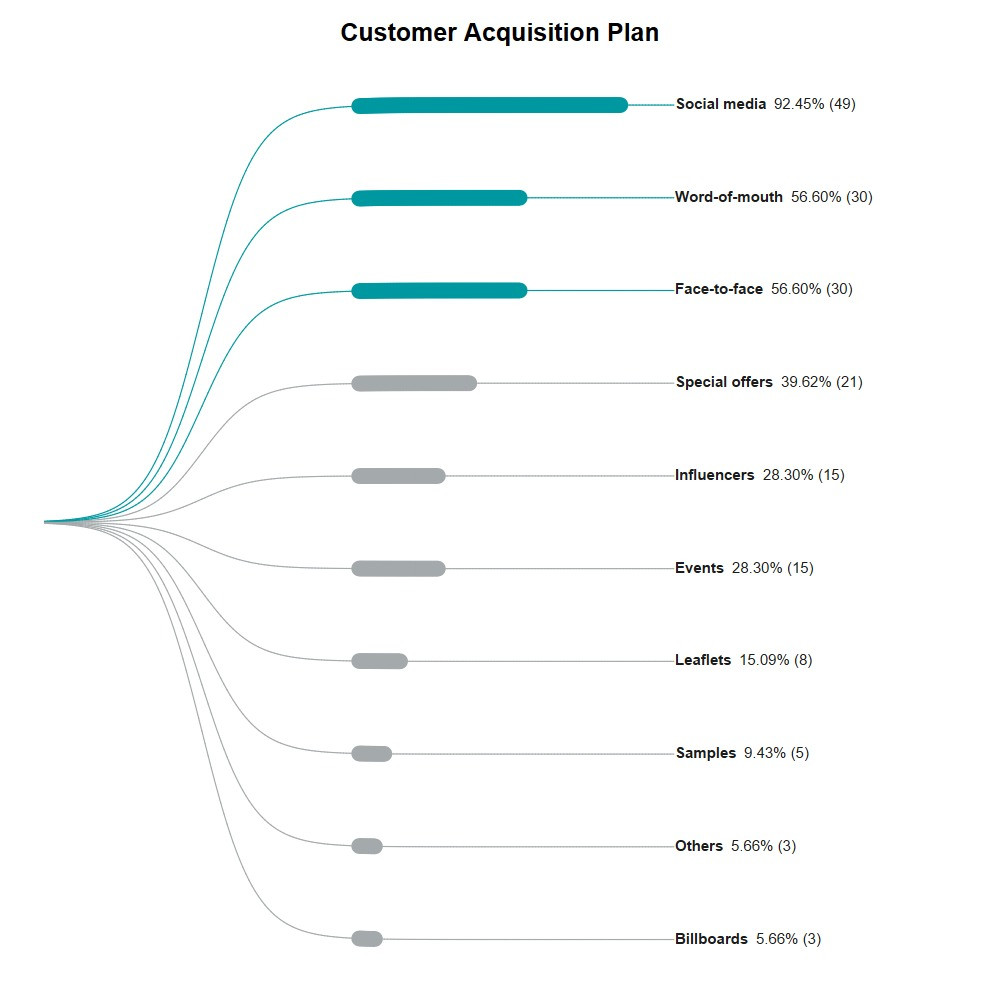

Customer Acquisition Plan

Social media ranked first as the main customer acquisition plan, followed by word-of-mouth, then direct connection (face-to-face), and influencers ranked equally in third place.

Interestingly, influencers dropped to fifth in the current findings. While the other three remained exactly in the same position as the best methods of customer acquisition. Worth noting that word-of-mouth and face-to-face were ranked equally by respondents.

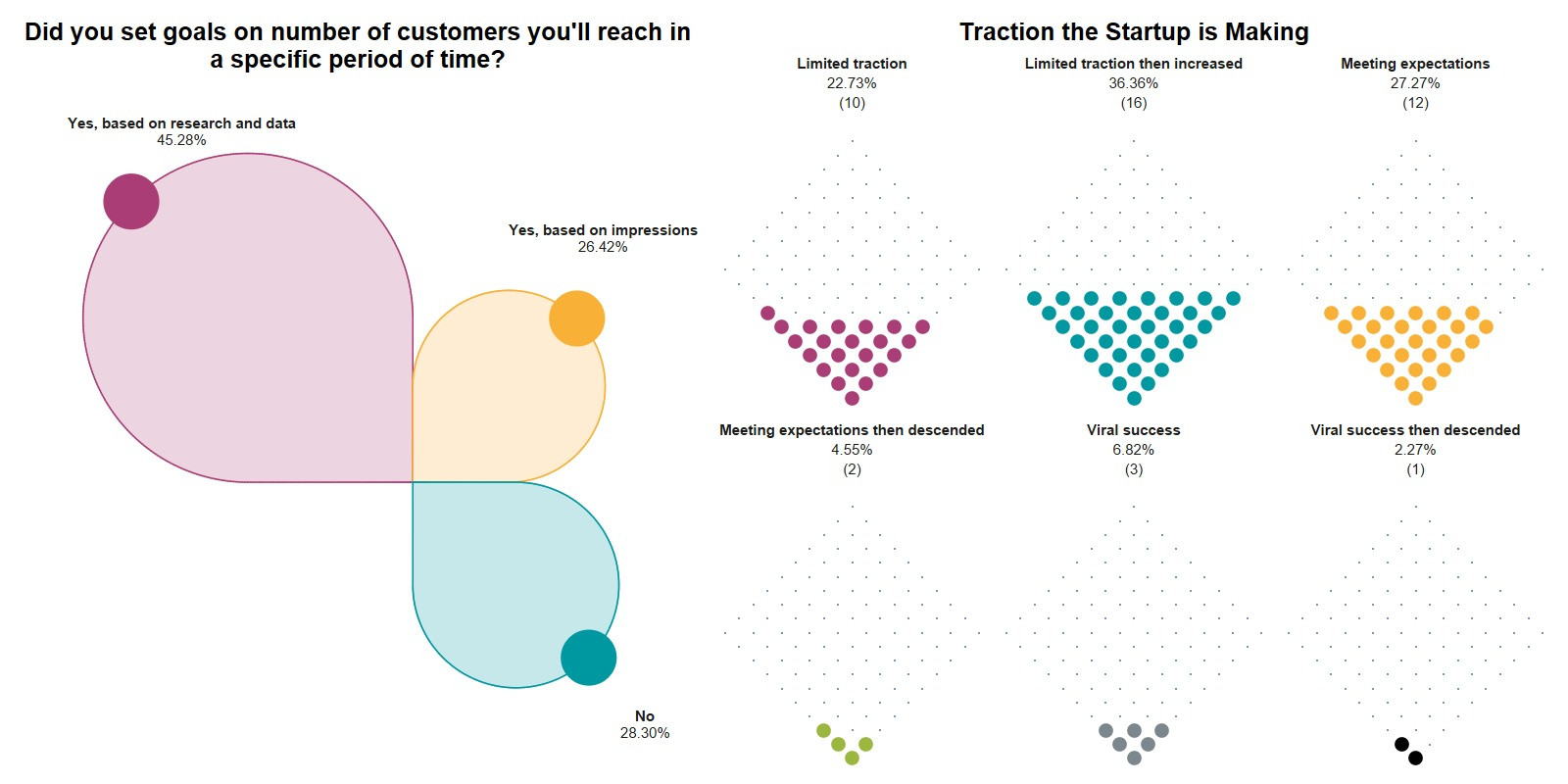

Goals and Customer Traction

Our findings indicate that the majority of the surveyed startups get limited traction that increases over time; the majority of surveyed respondents also claimed that they had set traction goals based on research and data. Combining goals based on research and data and having the patience to wait for traction to increase appears to be the most successful way to gain traction.

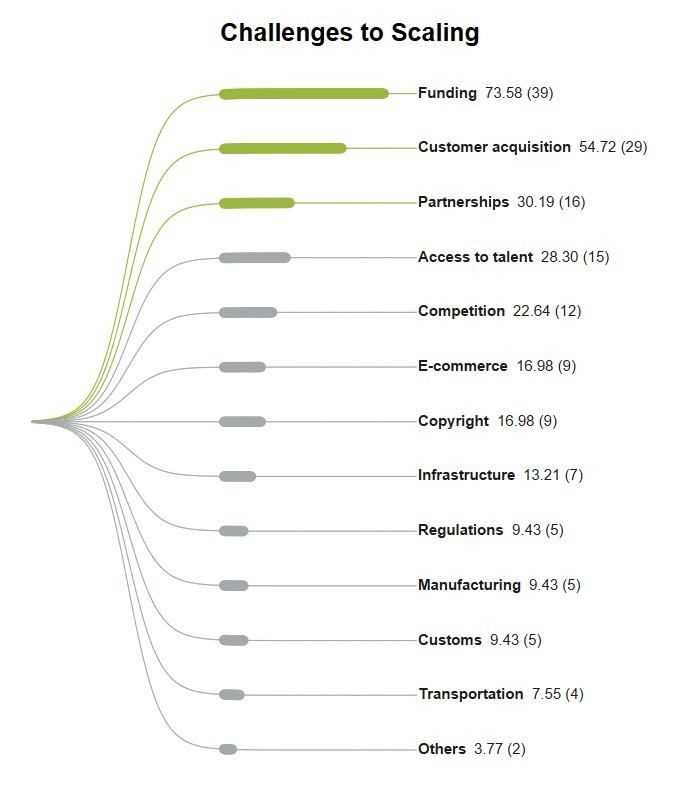

Challenges to Scaling

Scaling refers to the process of increasing revenues at a more rapid rate than costs. It allows a company to grow larger at a rapid rate because a relatively small investment is able to yield outsized returns, which can be reinvested to scale the business even further. The weak financial infrastructure in Iraq has pushed funding to be the main issue for scaling. The findings indicate that funding was the most prevalent challenge to scaling, followed by customer acquisition and partnerships.

Competition

State of Competition

Competition is a healthy way to improve startups. The more the competition is, the better the services and products are. The current findings indicate that the current level of competition in Iraq is suitable to create variability but not too high to drive startups out of business, with few competitors and a handful of competitors being ranked as the highest, respectively, by the respondents.

Position in Competition

Our respondents were asked if there was competition before or after they started their startups, 41.51% answered that there was before, while 37.74% answered after and 20.75% answered that competition came along around their launch time. About 45% of the same founders claimed that their position in the competition was equal to their competitors, 28.30% claimed that they lagged behind the competition, and 26.42% claimed to be ahead of most competition.

Competitive Advantages

Most entrepreneurs reported that the quality of service/products (73.58%), innovative ideas/features (66.04%), and customer care (49.06%) as their competitive advantages are most commonly reported by entrepreneurs. These advantages show a customer-centric approach taken by entrepreneurs to differentiate their startups from competitors.

Funding

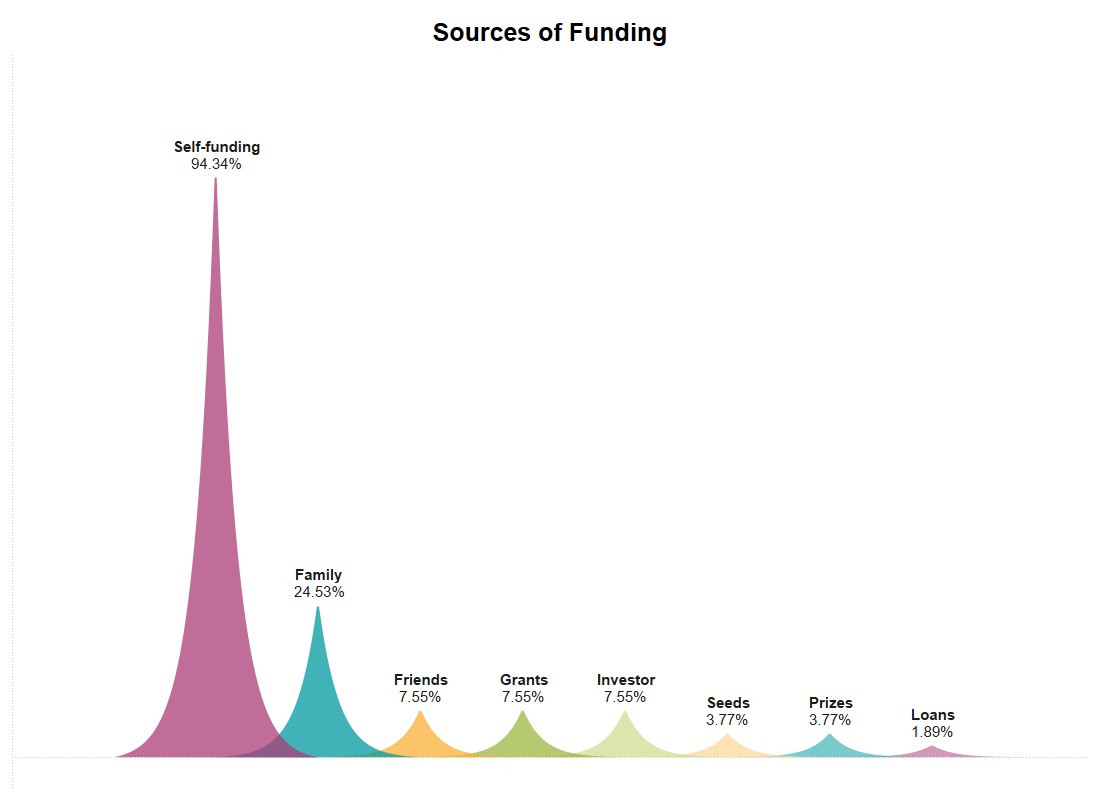

Sources of Funding

Self-funding is the most prevalent source of funding for our respondents. This is an indication of the actual lack of investment opportunities and seed capital funding in Iraq. To combat that lack, KAPITA launched the Iraqi Angels Investors Network (IAIN). IAIN is Iraq’s first angel group which comprises a cluster of distinguished Iraqi businessmen and entrepreneurs with the mission of providing support to the entrepreneurship ecosystem to revitalize the country’s private sector.

Seeking Funds

The majority of respondents are not seeking funding but planning to seek it in the future, which reflects the immaturity of the funding infrastructure of the country and the need for more improvement so it would be more appealing to the founders. In comparison, those who are actively seeking funds ranked second.

Conclusion and Recommendations

Female founders are very underrepresented in the Iraqi ecosystem and must be encouraged to enter the Iraqi market and become major players in the scene.

There must be a push toward business-oriented learning institutions as most entrepreneurs are founding startups in fields other than their studies and are indicating little to no benefit from their studies. A structural change in the Iraq education system is needed for a long-term solution and establishing business support programs or an institute to bridge the gap most entrepreneurs now have in their skillset.

Support programs for current employees in the private or public sector who want to pursue an entrepreneurial path are needed as many current entrepreneurs, for financial reasons, are also employed and thus lack focus on their startups.

Founders must focus on selecting their team correctly and develop ideas with them, so they could better adapt and shift the business into an aligned direction.

Since the business-to-customer market seems to be the most crowded, businesses should focus business-to-business and business-to-government markets, which appear to have more opportunities.

There must be more incentifying initiatives that target SMEs and startups and more regulations that are specific to them in regards to bank loans.

View the pdf version of this article

View the 7the issue of Business LANDSCAPE MAGAZINE