Amer Salih

CEO and Founder, iQ Cars

Iraq had a closed market for a long time that lasted until the late 1980s. The car market was controlled by the socialist government through GAMCO (General Automobiles and Machinery Company), and fleet deals were made with automotive distributors and manufacturers abroad to import vehicles into the country. The units were sold at subsidized prices to government employees.

The people who were not entitled to government-subsidized cars had the option to buy second-hand cars at the local car market, which led to a growing number of local used-car markets in major cities.

It was around the mid-1990s when the new interim administration of Kurdistan Region (KRG) opened the borders for the private import of vehicles, then after 2003, the private car importation market exploded. Unfortunately, there is no reliable data to know exactly how many vehicles were imported during that period, but some estimate the number to be over half a million annually.

It is difficult to estimate the automotive market size in Iraq. However, based on analyzed data that was provided by the government, iQ Cars, one of the major marketplaces for automotive in Iraq, estimates the annual market size to be $35-$40 billion based on 1.4 million sales transactions.

Automotive distributors started to establish their presence in the country after 2003. For the past 15 years, more than 40 automotive brands have commenced operations through authorized dealerships. The number of brands is forecasted to reach more than 80 within a few years due to the increasing popularity of Chinese automotive brands.

Authorized dealerships have relentlessly tried to change consumer behavior, focusing on delivering quality services and providing a long-term warranty, hoping that the consumer would be drawn to the quality of service rather than the low prices. Retail sales are increasing at authorized dealers but are still far from the ability to impact the market.

The local car sellers, or “showrooms” as they are commonly known in Iraq, are still much in control of the market. Their strategy lies in exploiting their low monthly expenses to push for high-quantity sales with lower margins instead of focusing on customer service. The automotive distributors are eager to reach higher sales volume, competing with other brands and supplying vehicles to the local car showrooms to reach their targets. It is not uncommon for consumers to find the exact same car at a lower price in the local car showrooms than the authorized dealer of those cars. These strategies of showrooms and automotive distributors created a cycle fueled by the authorized dealers' and distributors' sales targets and has only empowered the local car showrooms to outperform the authorized dealerships in sales. This has led to retaining low-quality customer services in the local car markets.

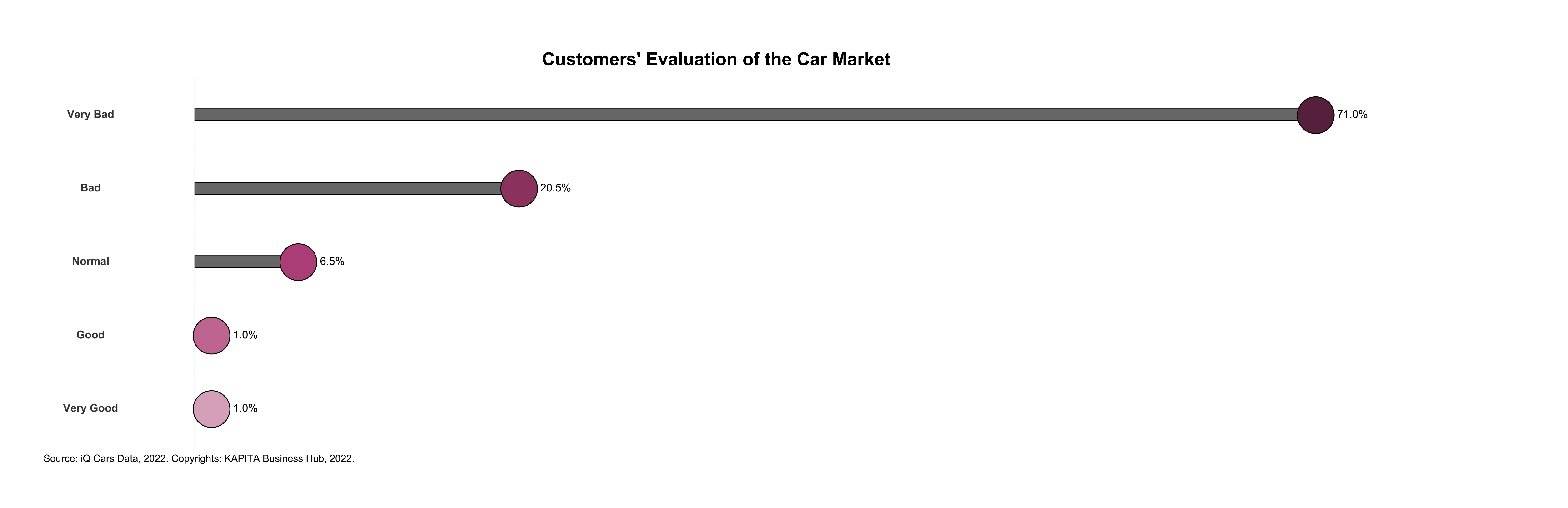

A survey conducted by iQ Cars in March 2022 interviewed 200 car buyers in Iraq and showed that 92% of car buyers consider the experience of visiting the local car market terrible or bad.

Most Iraqis believe that the local car markets are crowded and messy, prices are confusing, and confidence in car dealers is at an all-time low. It is common practice that car buyers consult with a relative or friend who has experience in the car market to evaluate car prices and negotiate with sellers. Car selling is no less painful process, frequent visits to the car market are required, and it comes with questionable methods by some car buyers.

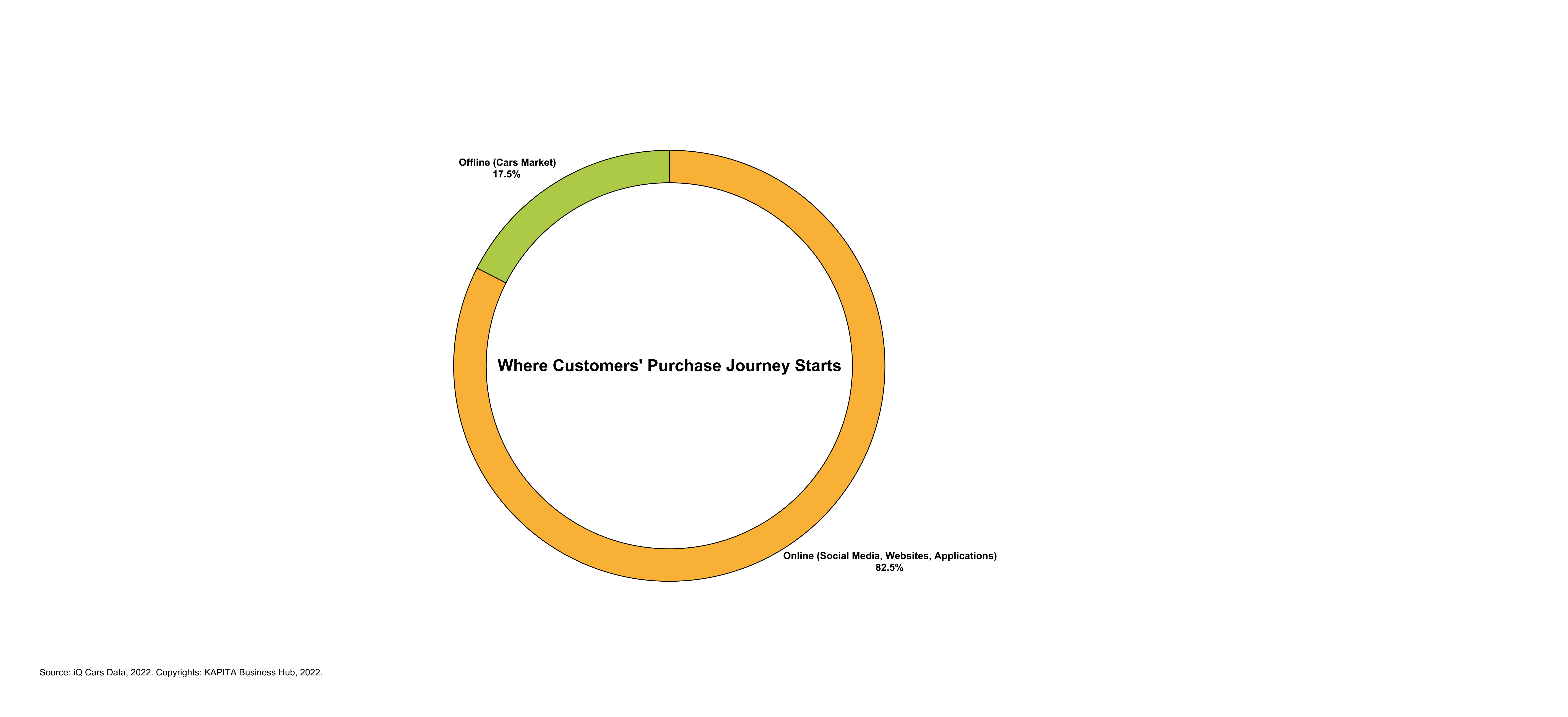

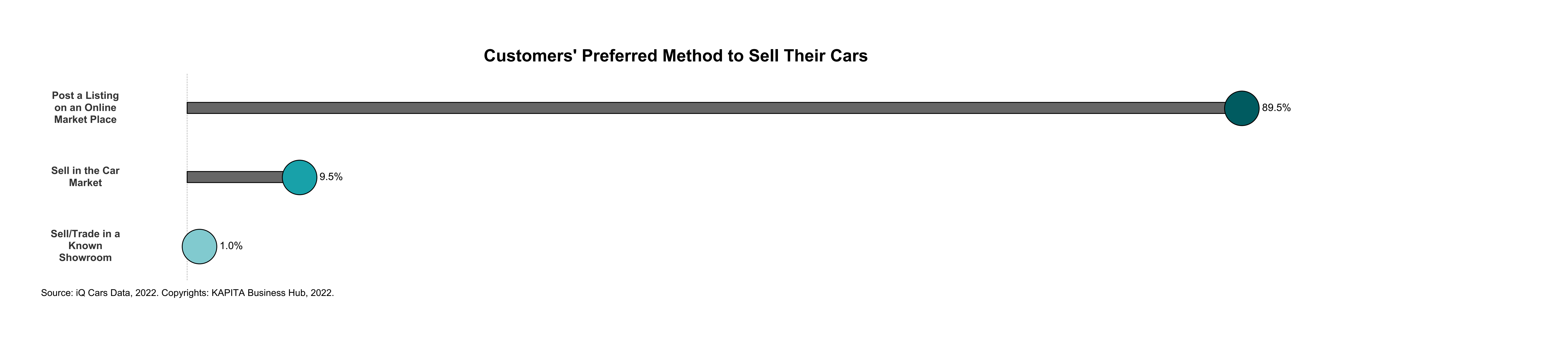

Another surprising figure from the survey showed that 83% of car buyers start their car-buying journey online. Few car dealerships or showrooms, with the exception of authorized dealers, have developed a digital journey for their customers or even a functional website. Social media pages and channels are used as part of their digital solution for customers.

Moreover, a major part of the market is now placed on social media groups and pages. It is easy to find hundreds of groups specifically created for only a certain car model, for example, the relatively similar and popular SUV cars models in the Iraqi market, the KIA Sportage and Hyundai Tucson. There are over hundred of Facebook Groups with hundreds of thousands of members with frequent posting of over ten posts a day, where car owners post about their cars' specifications. A significant portion of the daily transactions in the car market happens through these social media groups.

Social commerce is a growing market worldwide, but when it is a very large part of the market or maybe the largest, it indicates the highly unorganized car marketplace market in Iraq. Fraud and lack of benchmarks make the process foggy for customers and negatively impact the market dynamics.

Car dealers and "showrooms" are using social media to promote their cars. However, there are many limitations with social media pages for car dealers, they require frequent content management to keep momentum, and paid ads are crucial to have the necessary reach to get qualified leads. Organic leads generated from social media pages are few and qualified prospects are even fewer, and the workload becomes unbearable for even the most established authorized dealers. The digital customer journey requires more than just answering customers on Messenger.

It is a distressing customer journey with many pain points, and very little has been done to improve the situation in one of Iraq’s largest markets. Customers are demanding more digitized services and added-value services to enhance their buying experience. It is a difficult transformation for a relatively new emerging car market recovering from decades of war, political unrest, and economic instability. Still, it is finally time for Iraqi car buyers to experience better services. It is not enough to get quotes from dealers, it should be seamless to book a test drive, compare auto finance solutions, apply for loans and book delivery dates, and many more to improve the customer journey.

Cars listing websites and apps started with Mredy.com in 2008, then the regional player, OpenSouq, entered the market in 2014, and iQ Cars started operating in 2020. They are all aiming to create a more organized market and a smoother, seamless customer journey. iQ Cars provides more tools to empower the car buying experience, such as comparing vehicles in detail and enabling car buyers to monitor the marketplace and get notified when their preferred car is available for sale.

The Iraqi consumer is becoming more and more tech-savvy and is making a more conscious purchasing decision; there has not been a better time to digitalize the customer’s car purchasing journey.