The Investment Landscape: Iraqi Corporate Start to Venture

Ali Al-Suhail, CFA

The build-up to the elections and the event itself has imposed some silence on the investment landscape in Iraq. However, as the news winded down, the investment activity has picked back up. What followed was the announcement of a new fund to be directed at Iraq, with the general partners being existing and established investors in the ecosystem; Mohammed Khudairi from Iraq Tech Ventures, Omar Al Handal from The Station, and Bassam Falah from Innovest. The fund will focus on Iraqi startups at the Seed and Series A stages and will be called Iraq Tech Partners.

We are also seeing increased activity from regional and global startups raising larger rounds to enter the Iraqi market. ZoodPay, a “Buy Now Pay Later” (BNPL) app has successfully completed a $38 million Series B fundraising aimed at expanding and growing its operations in Iraq. Rocket Internet, the German internet conglomerate, has launched a new ride-hailing venture; Baly, in Baghdad and has since expanded to food delivery. There are increasing indicators that more regional and global players are coming into the market.

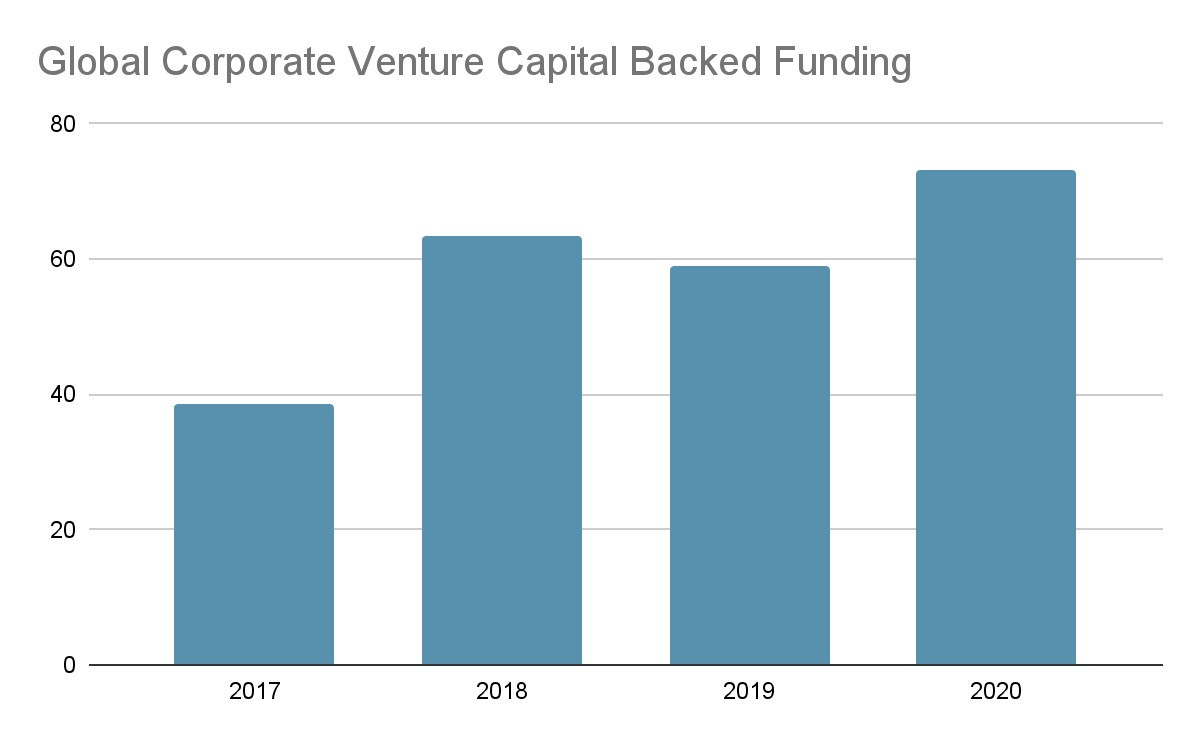

In other news, Al Sharqiya Media has announced an investment into Orisdi; an e-commerce business, and Earthlink announced an investment into IoT Kids; an edTech platform focused on teaching digital skills to kids. Both investments were facilitated through the Iraqi Angel Investors Network, but more than that they are the first announced venture investments by Iraqi corporates. Corporate Venture Investing has been on the rise globally with global corporate capital-backed funding reaching $73 billion in 2020.

The dominant nature of CVC backed investments is for the company to outsource innovation and capture synergies. In the Iraqi setting, this is quite interesting as the corporate culture has been built around developing business internally with little focus on external investments. As the world continues to be disrupted by the rise of digital models, many traditional businesses struggled with building digital equivalents internally. Investments into startups by corporations have also faced issues around culture differences, governance, and hefty valuations.

Accounting for the startup culture is a critical one. Founders by nature are highly ambitious entrepreneurs that are looking to take on large problems and grow fast. Both factors create a sense of urgency for founders that will need a responsive counterpart on the side of the corporate. Rigid processes and procedures are valuable when you have well-established operations and long years of operational history. But for a startup, they slow down the speed of experimentation and learning which ultimately impacts its growth. Corporates need to put in place mechanisms wherein the startup is provided access to and is actively engaged with the strategy team linked to its operations.

A common one is using a point of contact in the CEO office that has the capacity to engage with the startup and understand their needs. As a corporate, it needs to empower that point of contact and might consider having him or her as the board representative or responsible for a budget of expenses and resources (beyond funding) that the company will use to support the startup. It is important that the corporate does not consider the startup as an extension of its operations and maintain the startup's independence.

This brings us to the second part which is governance and it starts before the investment takes place. Corporate should develop a clear investment strategy on why it will invest in a startup and incorporate this into governance in its relationship with the startup.

We can look at a common case in Iraq where the corporate invests in a startup because it can enhance its value significantly through the cooperate platform. In such a case, the corporate and the startup should work closely together to understand what such support will look like through a clear business plan. The corporate should also be clear on what it expects from such support whether it is being used to appreciate the value of the business or will be part of its offer to the business (pay less because of it). The corporate should articulate the aforementioned governance issues in its offer to the startup which will not only help establish responsibilities but also set expectations. Clarity and understanding of what the corporate expect from the business can help it design an effective board of directors with the startup and better identify how the board will help the startup grow.

On valuations, most startups in Iraq need capital and can accelerate growth with the established platforms of the larger corporates. This creates pressure on valuation and provides clear synergies to be captured for Iraqi corporates investing in startups. Considering that many of the corporations in Iraq are cash-rich, there seems to be a great opportunity for them to take on more ventures.