In light of the current pandemic, and in his recent live on KAPITA, Ali Al Suhail noted three key global trends:

Global Trend 1: Bridging physical distances

Covid-19 has made physical interactions almost impossible creating a great opportunity for startups to leverage this trend. Many investors do believe that this trend will continue into the future as consumer behavior changes and adapts to living with the ongoing pandemic. We see this is reflected in how investors are selecting their investments with fields like digital healthcare, digital education and e-commerce are getting special attention. The early-stage startups that received the highest investments in MENA operate in these fields:

Covid-19 has made physical interactions almost impossible creating a great opportunity for startups to leverage this trend. Many investors do believe that this trend will continue into the future as consumer behavior changes and adapts to living with the ongoing pandemic. We see this is reflected in how investors are selecting their investments with fields like digital healthcare, digital education and e-commerce are getting special attention. The early-stage startups that received the highest investments in MENA operate in these fields:

● Vezeeta – Telemedicine and doctor booking application

● Nana - Online grocery delivery

● Okadoc – Telemedicine and doctor booking application

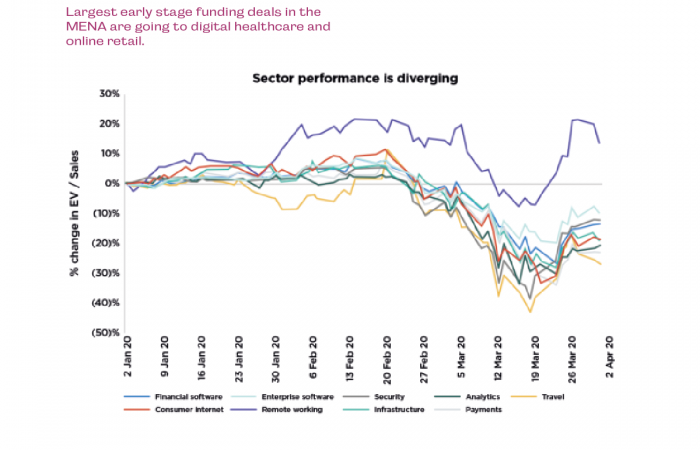

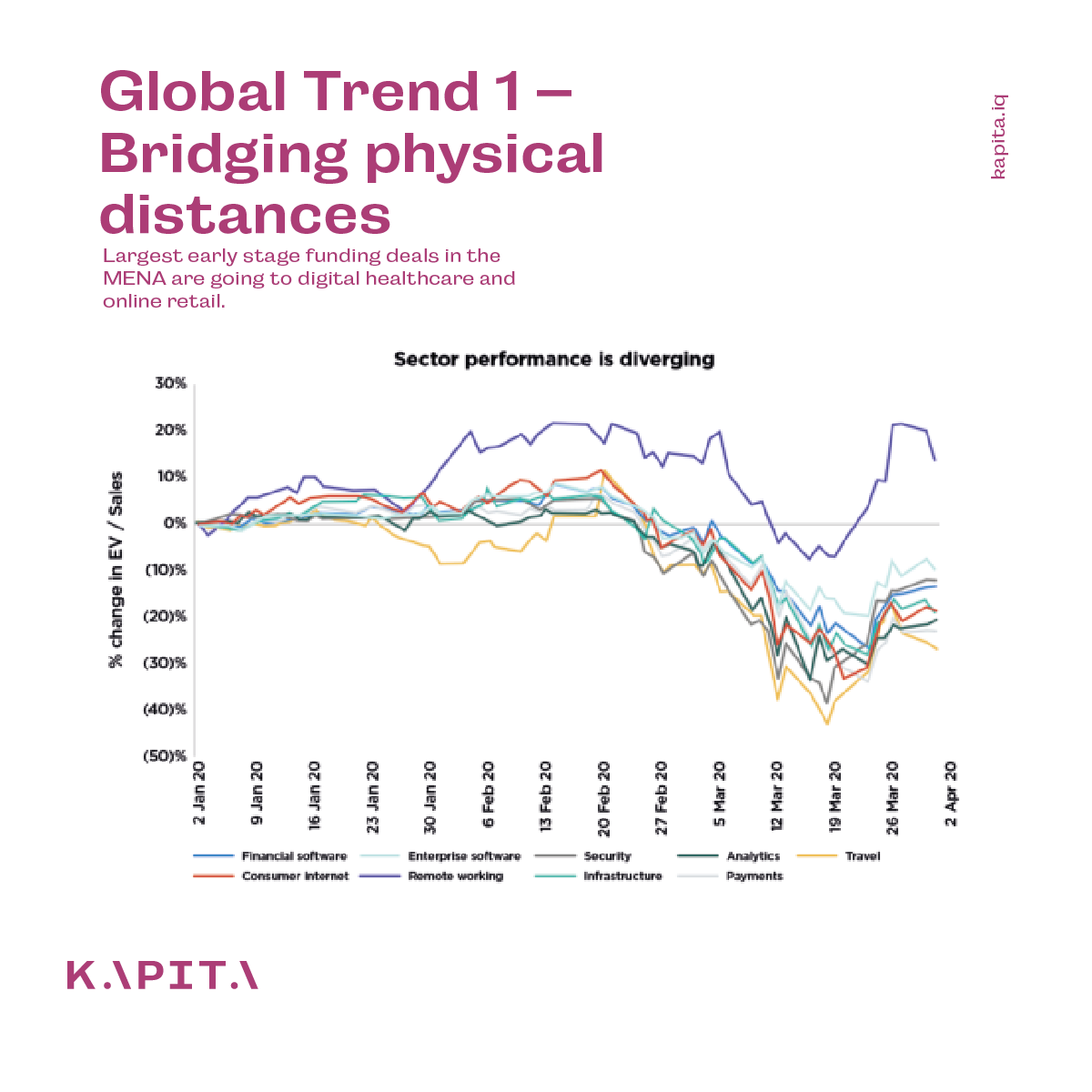

This trend was also reflected in the stock market. We saw the share prices of companies like Amazon, Ocado, and Netflix being defiant and increasing while general indices decline. Another area that is experiencing similar attention is the “Future of Work”, which focuses on how teams and businesses will continue to operate in a Covid-19 world. As we have seen over the past few weeks, Zoom meetings became a stable part of our lives, and the main venue for most of our meetings driving the share price of Zoom up by more than 50%. Such digital tools are becoming essential elements of communications and project management in this new era.

As we spend more time living in the “new normal” where coronavirus is a part of our lives, expect startups bridging physical distances to become only more attractive for investors.

Global trends 2 - Focus on follow-ons and decrease in valuation

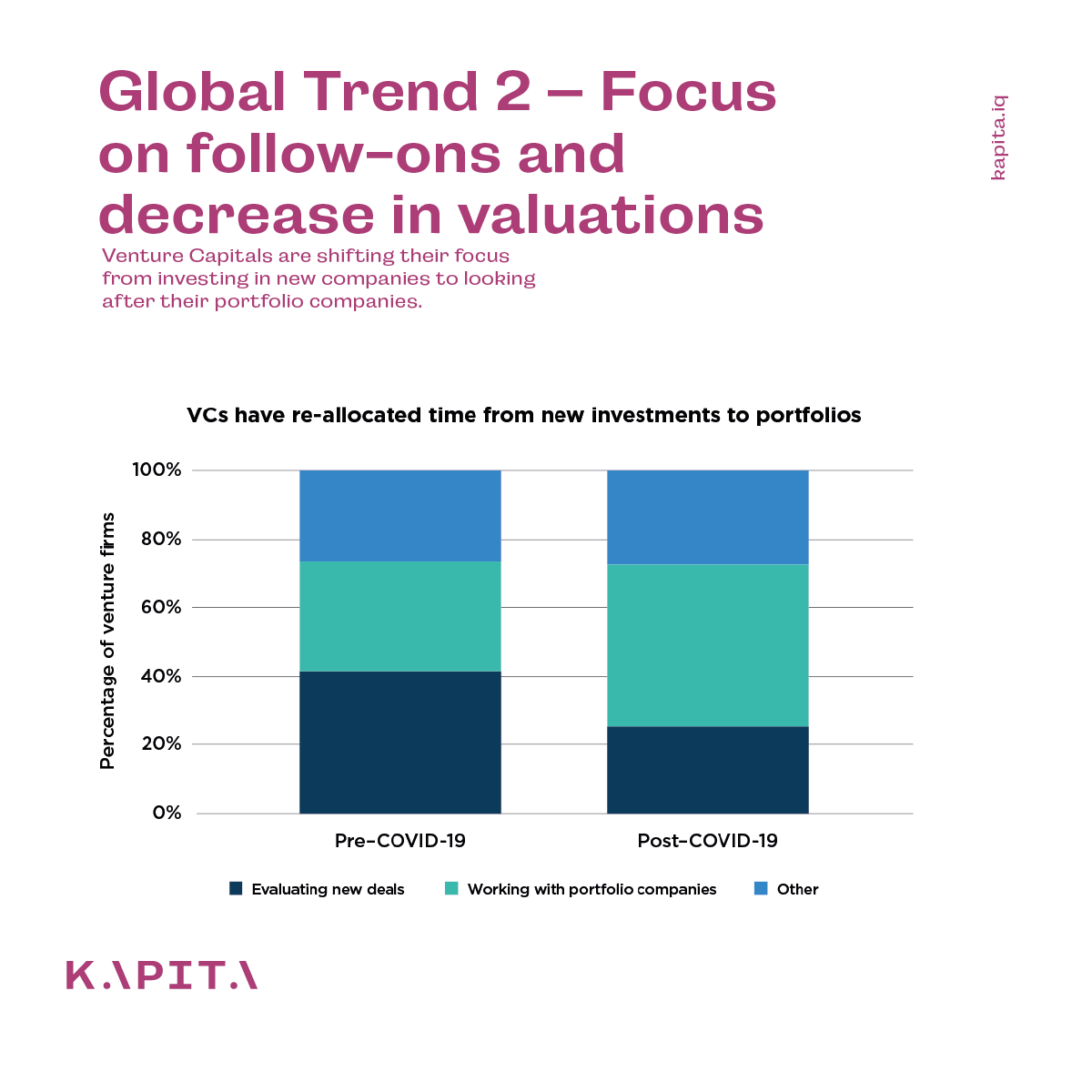

The second global trend is a shift in early-stage investors' focus and a potential decrease in the valuation of startups looking to fundraise.

Most Venture Capitals (VCs) are currently shifting their focus from investing in new companies to looking after their portfolio companies. VCs are looking to support their portfolio startups by helping them navigate the ongoing crisis and giving them the strategic advice required to navigate current markets.

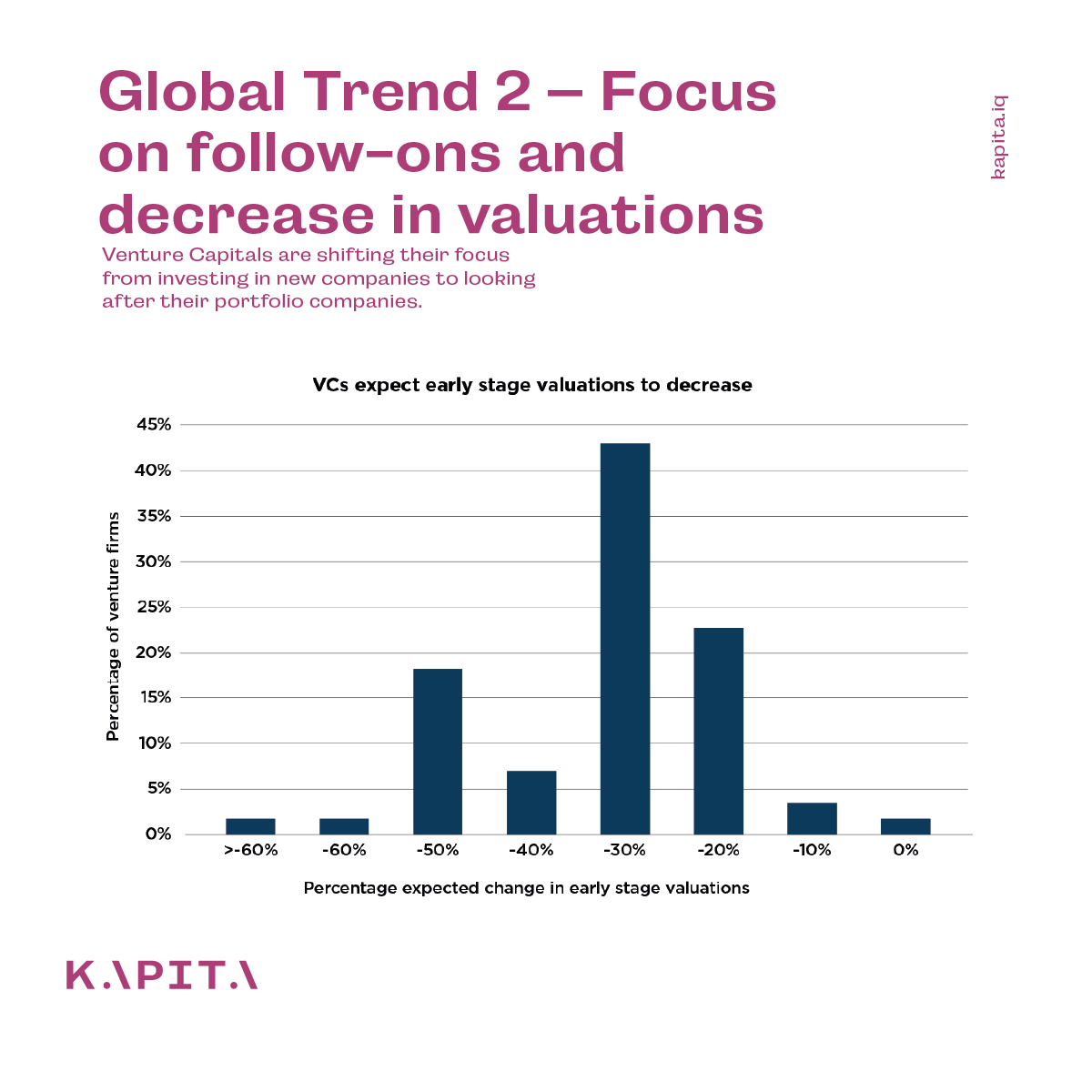

Valuations are also expected to decline. According to Numis Growth Global Solutions, most VCs are expecting the valuation of startups to decline between 25% to 50%. However, sectors such as EdTech, HealthTech, and Future of Work remain very attractive to investors and might see an increase in valuation.

Due to decreased valuations startups are looking to raise funds through different investment mechanisms to sustain their businesses and cope with the current downturn. While equity financing is still common, we expect to see an increased reliance on debt as a form of financing through convertible or revenue linked structures.

Global trend 3 - Profitability over scalability

After a long period where growth was at the center of VC assessment of startups. The current pandemic is leading to a shift in focus and balance between profitability and growth. With current

market uncertainties, investors are preferring for startups to focus on their current position in the market or leverage Covid-19 trends over chasing expensive growth.

Following this trend, investors are stressing on the importance of unit economics for startups and small to medium-sized companies. Metrics such as customer acquisition cost (CAC), churn rate, and Customer Lifetime Value (LTV) are becoming increasingly relevant to evaluate startups' attractiveness in the eyes of investors.

We expect this shift to continue. The current market dynamics provide investors with the upper hand in choosing where to allocate their capital. Investors will be looking to invest only in the best companies. For startups to have used their capital efficiency and balance profitability with growth will be key points to determine the startups' attractiveness.