Access to Finance in Iraq: An Analytical Study

Abdal Ghany Al-Hassani

Country Manager, GroFin Iraq

Access to finance is the ability of individuals or enterprises to obtain financial services, including credit, deposit, payment, insurance, and other services. Access to finance plays an important role in economic growth, boosting the employment rate, increasing market competition, and reducing poverty.

A Brief History of the Iraqi Banking Sector

Historically, the first bank that started operations in Iraq was the Ottoman Bank in 1890. In 1912, the East Bank established its first branch in Baghdad, followed by the Iranian Bank in 1918. Those were the only banks that operated in Iraq until 1935, when the government of Iraq established the Agricultural Bank. Then in 1941, the Alrafidain Bank opened as the first retail bank in Iraq. In 1964 the Iraqi government nationalized the banks; this step ended the existence of private and international banks in Iraq.

In 1988, a new bank was established by the Iraqi government called Al-Rasheed Bank.

While the first private bank was allowed in 1999, currently, there are seven state-owned banks, 53 private banks, 12 representative offices of foreign banks, and 2 offices of foreign Islamic Banks. Also, there are 16 companies that provide mobile payment methods, issue debit cards and provide IT infrastructure for online payments.

As shown in table 1, the total number of bank branches remains low: there are 904 branches all over Iraq, which means that each branch serves more than 25,000 adults.

Citizen Distrust in Banks

In 1990, Iraq faced an international sanction issued by the United Nations Security Council. As a result, many countries banned financial and trade relations with Iraq. This heavily affected the Iraqi economy, and the Iraqi people started withdrawing their money from banks.

The Central Bank of Iraq then instructed banks to refuse money withdrawal to avoid bankruptcy. This created a distrust amongst the Iraqi people of the whole banking system, especially towards private banks, that lingers to the present day, with only 22% of the Iraqi population having bank accounts.

Before 1990, the value of the Iraqi dinar (IQD) was 3 USD. Due to international sanctions, it has declined rapidly. In 2003, the IQD was worth 0.0002 USD. Today, 1,470 IQD is worth one dollar.

Corruption, alongside uncertainty in the banking system, security and political instability, have affected the banks’ reputation, especially the private banks, and led the Iraqis to distrust the banks, both private and state-owned, while Transparency International ranked Iraq 157th in its corruption index.

E-banking methods available in Iraq are very limited. This has created a major problem within the sector. Although steps have been taken in recent years to fill this gap, the situation is still underdeveloped. In an attempt to enhance e-banking in Iraq, the Central Bank of Iraq (CBI) has issued many legislative initiatives and action plans to enable the banks to start providing e-services such as debit cards and mobile payments. In 2016, the Central Bank launched the National Switch to connect all the banks together and integrate the bank’s systems into one central network.

The CBI’s efforts to improve the situation have also focused on the organizational structure, the IT infrastructure, aspects of risk management, and the nature of banking supervision. Efforts have also been made to streamline communication between government authorities and the banking establishment.

The number of ATMs is still very low, which means that people have to go through lengthy procedures to withdraw money. The limited working hours should also be noted: Iraqi banks normally close at 12:00 or 1:00 pm, which constitutes another obstacle for individuals to conduct banking transactions. However, some banks are starting to offer longer working hours and set up ATMs due to the increasing demand and competition between the banks.

Access to Finance is Measured by Two Dimensions:

Availability/Penetration: This refers to the easiness of accessibility and availability of financial products for new and existing users. A comprehensive financial system must have as many users as possible. Hence, it must penetrate widely among those its user base. Where two metrics are usually used to evaluate the availability:

Number of bank branches per 100,000 adults:

The total number of bank branches in Iraq, as of December 2020, is 904, with 327 located in Baghdad and 574 in other provinces, which means that each branch serves more than 25,000 adults, this represents a low coverage rate compared to the neighboring countries.

Table1: Bank Branches per 100K Adults in Selected Countries

Country | Number of Bank Branches | Bank Branches per 100K Adults |

Iraq | 904 | 4 |

UAE | 1014 | 8 |

Jordan | 799 | 14.1 |

Turkey | 10,289 | 15.4 |

Iran | 23,000 | 31.1 |

Number of ATMs:

ATMs number plays an essential role in banking transactions' easiness and is considered a significant metric to measure the financial service availability.

Table2: Number of ATMs per 100K Adults in Selected Countries

Country | Number of ATMs | Number of ATMs per 100K Adult |

Iraq | 1,170 | 5.35 |

UAE | 4,542 | 52.49 |

Jordan | 2,094 | 30.56 |

Turkey | 52,798 | 82.31 |

Iran | 60,933 | 88.65 |

Usage rate of financial services:

The usage rate of financial service is a critical aspect that reflects the efficiency of the financial sector. We can use three metrics to measure the usage rate of financial services:

Number of accounts:

The number of bank accounts provides an incomplete picture of financial services usage because if the bank account is not used, it is not worthy of consideration. However, studies show that the increased number of accounts is a base for future development in terms of financial access.

Table3: Percentage of Bank Accounts to Adult Populations

Country | % of Banks Accounts to Population Ages 15+ |

Iraq | 22.67 |

UAE | 88.21 |

Jordan | 42.49 |

Turkey | 68.59 |

Iran | 93.98 |

Credit to private sector

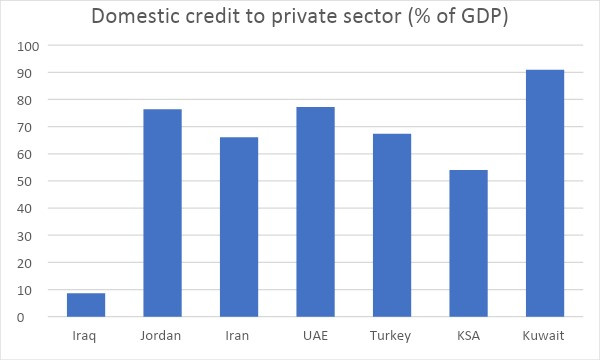

The domestic credit offered to the private sector is correlated mainly with economic growth; it is also an indicator of financial access and inclusion.

The graph below shows the rate of domestic credit to the private sector as a percentage of GDP; in 2018, Iraq had only a rate of 8%, this shallow rate hindering the economic development of the country and suggests that the banks have a more critical role in fulfilling toward the economy.

Figure1: Domestic Credit to Private Sector as a Percentage of GDP (2018)

Deposit to GDP rate:

Currently, there are more than 40 trillion IQD deposited in banks, which represents 17% of Iraq's GDP, whereas the average rate worldwide is 65%. This low rate confirms that banks have so far played a limited role in economic development.

Access to Loans Finance Opportunities for Small and Medium-sized Enterprises (SMEs) and Small Growing Businesses (SGB)

The limited access to finance in Iraq is demonstrated by the lack of availability and penetration of bank branches and ATMs, lack of credit provided to the private sector, and the inadequate banking services, coupled with the mistrust in the banking sector and reliance on cash-based transactions has led the Iraqi consumer to be underbanked. This has also reflected on Iraqi business owners and their SMEs and SGBs, creating a limited pool of financing products that cater to their needs, which restricted their growth opportunities.

However, a number of initiatives have been launched in the Iraqi ecosystem aiming to foster and support SMEs and SGBs in Iraq and facilitate access to finance.

Some are as follows:

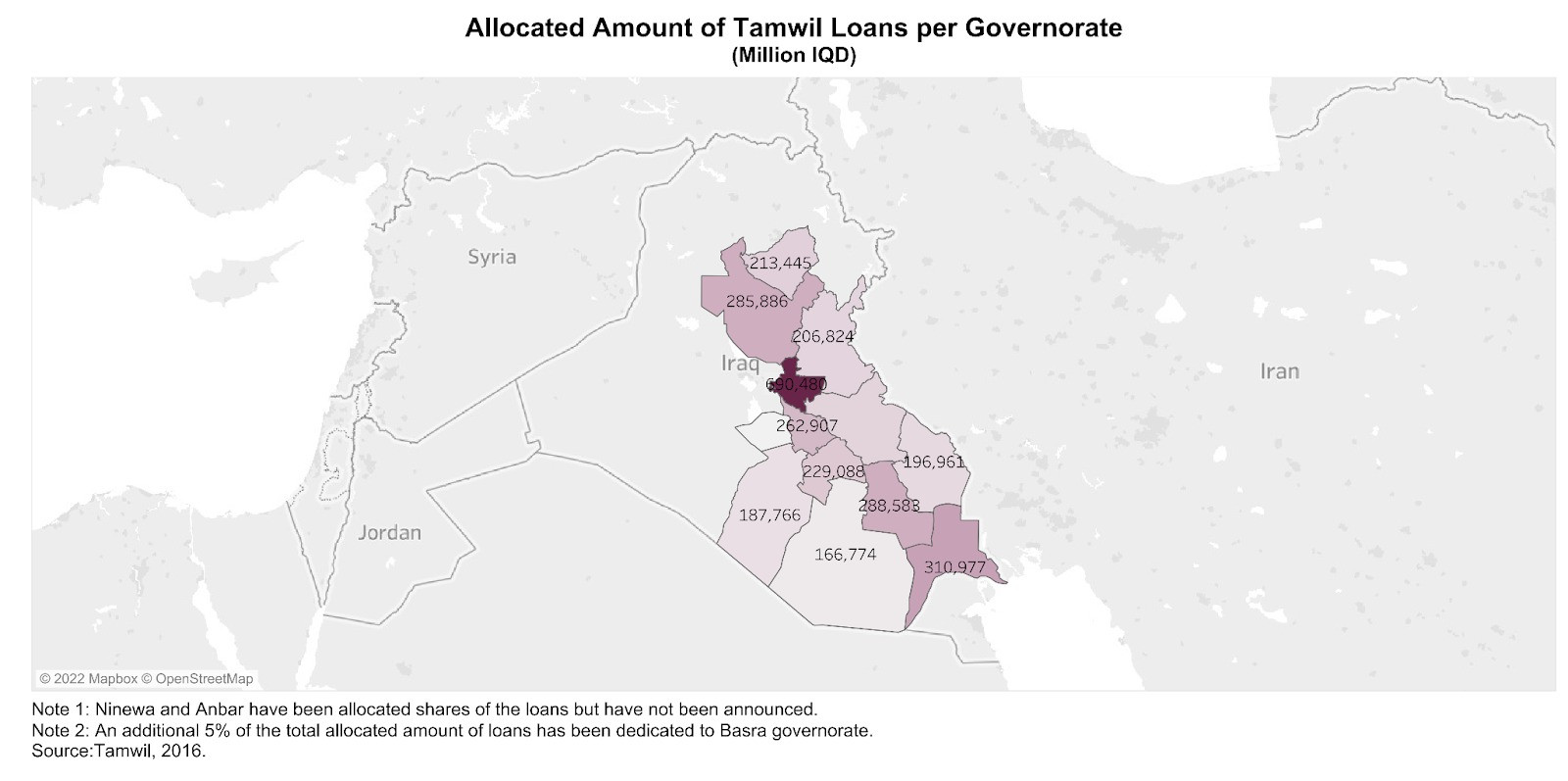

Tamwil is an initiative of the Prime Minister’s Office and the Central Bank of Iraq (CBI) to finance SMEs and startups by providing and facilitating loans. The initiative also involves the participation of the Agricultural Bank and Industrial Bank and the Iraq Private Banks League. The total amount of loans allocated is 5 trillion IQD and granted to projects in the agricultural and industrial sector projects, housing projects, and, more recently, in 2022, renewable energy projects. The renewable energy projects' loans come from Iraq’s commitment to the Paris Climate Agreement.

Tamwil aims to create new job opportunities, especially for the youth and fresh graduates, establish and rehabilitate the industrial facilities, and promote local production.

The applicants can access an electronic loan application form on Tamwil’s platform that allows them to submit their personal information, the details of the project they wish to finance, and the desired loan amount. Applicants can then print the information and submit it to the bank to which they are directed. Additionally, applicants can modify their information and track the status of their loan applications via Tamwil’s online system.

According to the project, loans are provided with some of the following criteria:

1) The loans are allocated to each governorate according to a credit plan calculated with the rate of 80% as a criterion for population ratios and 20% as a criterion for poverty rate.

2) The loan applicant should be an Iraqi company, association, or individual 22 years old or above.

3) The annual interest on loans is 4%.

4) Loans are granted to projects in the agricultural and industrial sectors according to the following classification:

Small business loans: up to a maximum of 500 million IQD.

Medium projects loans: up to a maximum of 3 billion IQD.

Loans for large projects: provided for projects that exceed 3 billion IQD up to a maximum of 20 billion IQD.

Loans for strategic projects that exceed 20 billion IQD.

6) The term of the loan is five years, except for the grace period of one year, starting from the day of disbursing the first payment to the loan applicant.

The Nomou Iraq Fund (NIF) is a Grofin-managed program that has been assisting entrepreneurs, startups, and SMEs in Iraq for over nine years by providing them with expert advice, continuous guidance, and funding to expand their businesses. The GroFin Iraq investment team establishes long-term personal relationships with each entrepreneur, designing a suitable deal structure and loan repayment period and offering ongoing business support based on the specific requirements of each project.

Established businesses that have been operating for 2-3 years and have an annual turnover of 1.5 times the loan amount are offered medium-term loan capitals between US$100k and US$2m for a loan duration of 3-8 years. These loans are provided to businesses that operate in education, healthcare, agri-processing, manufacturing, or key services (Energy/Waste/Water/Recycling). Other businesses and startups may be endorsed on an individual basis if they have a beneficial social and economic impact, such as providing jobs, sustaining livelihoods, empowering women, and fostering environmental sustainability.

Northern Iraq Investments (NII) is another relief program administered by Grofin. The program provides financial and technical support to SMEs operating in Nineveh province or in northern Iraqi regions affected by ISIS.

NII also provides assistance to startups backed by an entrepreneur with substantial experience, a proven track record, and a strong financial commitment to the enterprise.

Loans are provided in a manner similar to that offered by NIF. Additionally, the NII COVID-19 SME Support Program provides existing businesses in northern Iraq with short-term business loans between US$10k and US$100k to assist them in overcoming the residual effects of the COVID-19 pandemic and preserving employment and livelihoods. The COVID-19 program offers loan terms ranging from 12 to 36 months, with the first six months being interest-free and the remainder accruing interest at a rate of 8% on reducing balancing (amortization).

Orange Corners Innovation Fund (OCIF) is a subsidy program to Orange Corners that aims to improve access to finance for startups and entrepreneurs and foster innovation in the Middle East and Africa. OCIF has been launched in Baghdad as an addition to Orange Corners Baghdad that is implemented by KAPITA Business Hub in partnership with the National Bank of Iraq. It is a 1 million euro fund supporting the businesses in Orange Corners Baghdad. The fund consists of two tracks; the first includes providing a monthly allowance for entrepreneurs of 320 euros and a voucher for business services valued at 2,400 euros offered to entrepreneurs with certain criteria in addition to financial literacy training sessions. The second track includes a 27.5 thousand euro divided into two equal parts; one part is provided as a grant while the other is a loan with zero interest rate offered to the entrepreneurs who graduated from Orange Corners Baghdad and were able to successfully meet the selection criteria for the loan. The loan payback plan is determined according to the startup’s cash flow, providing entrepreneurs with a flexible plan that caters to their needs and business model. The second track also includes pitch training and a business implementation plan.

CHF Vitas Iraq is a nonprofit microfinance institution that was established in 2003 with

headquarters in Babylon and has a network of 14 branches across Iraq. CHF Vistas has been facilitating access to finance for micro and small businesses to enable them to grow their businesses and increase their profits. They have also worked on rehabilitation and restoration of housing for many homeowners. CHF Vistas Iraq has created 20,715 job opportunities, disbursed 412,292 loans, and restored 34,699 homes. It also served 89,046 women and 189,479 youth.

The business loans offered to business that has been established for at least a year, the loans do not require the business to be registered. The loans are divided into micro business loans ranging from $100$ to $19,999 with a term of 12 to 24 months and small business loans ranging from $20,000 to $35,000 with a term of 18 to 36 months. The loan beneficiary should be at least 18 years old and younger than 65 years old and should provide a guarantor and collateral that can cover the loan repayment.

Financial access is directly correlated to economic growth and citizen well-being. Thus, the government needs to increase its efforts to increase financial access. The Central Bank of Iraq has spotted this importance by launching many initiatives to develop the financial sector, such as electronic transfer of public salaries, national switch, and others. Despite all these efforts, Iraq is still behind in all the financial access measurement metrics compared to other Middle East countries.

CBI, and other stakeholders, should work in parallel to enhance the infrastructure and legislation of the financial sector and increase the penetration and usage rate.